IRVINGTON, New Jersey (WABC) — We have all seen how check fraud has become a huge problem, with banks taking steps to combat check laundering and people stealing checks.

But what happens when you are a legitimate business owner, you get paid by another business, and even though the check clears your account, it is frozen for suspected fraud and you cannot “unfreeze” it “.

This frozen check had a snowball effect. A New Jersey family business deposited $23,000 it couldn’t use. The company therefore had to refuse work.

In construction, you have to get paid to get the supplies you need for the next job. You have to pay your workers, but there were no new jobs because their funds were in the freezer.

“You can look at it on your phone all day, it looks good on your phone but you can’t touch it,” said Andre Lockhart, the company’s owner.

The bank account of Andre and Maggie Lockhart’s small business has been frozen.

“It is written that deposit is permitted only. How can you run a business like that? It’s like putting your money into a bottomless pit,” Maggie said.

They’ve been struggling to climb out of this hole since receiving a check for $23,000 for repair work recently done at a rehab center.

they froze all their funds.

“Oh, it was devastating,” Maggie said.

“It’s very upsetting. I’m very upset and hurt,” Andre said.

The Essex County couple is unsure why the deposit made at the branch with a teller was flagged for unusual activity and had their account restricted.

“He said, ‘Oh, it’s fraud. It’s being investigated,’ at the very last minute, you have to sit there and wait,” she said.

The couple built their business in Irvington, New Jersey, from the ground up.

“She handles the accounts, I handle the business,” Andre said. “I do the work with my guys.”

Superior Contracting and Property Management, LLC started with small jobs and grew to manage buildings.

“The only thing I wanted was to be a credible African American in his business,” Andre said.

But today, their business is at a standstill, despite weeks of trying to prove that their cashed check was legitimate.

“I’m that person, I’m the main one doing this and they said no, it’s fraud,” she said.

With funds frozen, they dipped into their savings to pay salaries.

“Your workers have to be paid, they have bills to pay, they have responsibilities,” he said.

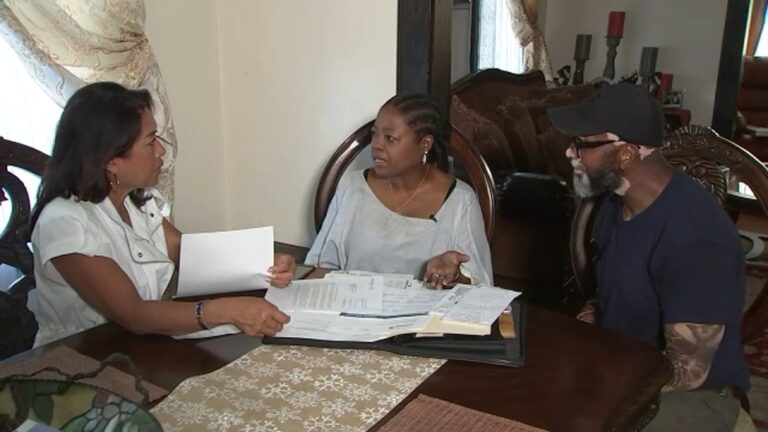

“How many times have you been there, by email?” asked Nina Pineda of 7 On Your Side.

“More than a dozen times,” he said.

Frustrated, they emailed 7 On Your Side.

Pineda contacted Capital One to request a thaw, and within 24 hours, it was done!

“They called me right away and said, ‘Hey, come get your money,'” he said.

$23,300 has been released and is ready.

“Thank you, thank you, thank you, Nina Pineda,” said André. “The best, she’s number one, after my wife, my mother, she’s number one!”

Capital One told 7 On Your Side it was happy to confirm the bank worked directly with the customer to resolve this issue.

Here are some points to remember:

Don’t put big checks in the ATM. The Lockharts went to the ATM, which is a good thing.

Bring your ID and business papers and ask to speak to a manager when dealing with large deposits.

It is not easy to unblock a frozen account.

Banks investigating possible fraud can take weeks. Having your business on ice can really do damage.

ALSO READ: Money-Saving Tips When Booking Your Next Vacation

7 On Your Side’s Nina Pineda gives tips for saving money when booking your next vacation.

———-

SHARE YOUR STORY

Do you have a problem with a company that you haven’t been able to resolve? If so, 7 On Your Side wants to help!

Fill out the form below or email us your questions, problems or article ideas by filling out the form below or sending an email 7OnYourSideNina@abc.com. All emails MUST INCLUDE YOUR NAME AND CELL PHONE NUMBER. Without a phone number, 7 On Your Side will not be able to respond.

Copyright © 2024 WABC-TV. All rights reserved.