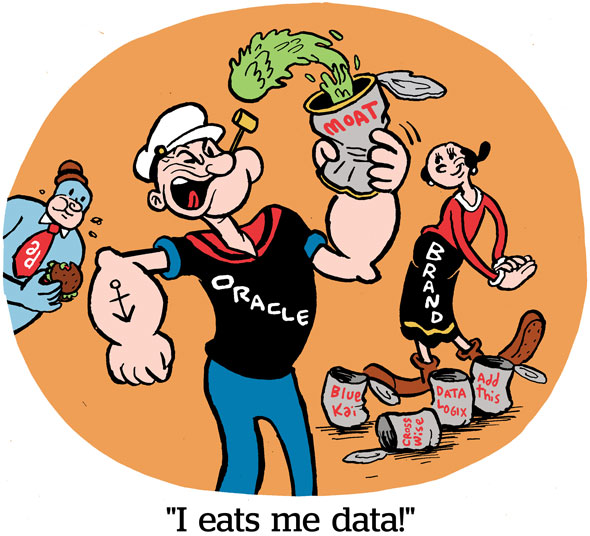

By now, the industry is well aware that Oracle, once the largest ad data seller in the market, will be shuttering its advertising division.

This is an ignominious end for Oracle Advertising, part of Oracle Data Cloud (ODC) which at one time included top players in the category, including Datalogix for offline consumer data, targeting contextual Grapeshot, Moat measurement and verification and BlueKai audience. walk.

Oracle’s advertising business will be supported through the end of September, but on the site it appears to be all but gone. “Oracle has determined that the Advertising business is not consistent with its current strategic vision,” according to the new homepage for the standoff.

So what happened?

Conversations with a dozen current and former employees paint a picture of the time and energy wasted in the years — and even hours — before CEO Safra Catz told investors that the unit advertising would be closed in the fourth quarter of this year. These employees claim that there was no warning and that they discovered that the advertising activity was over, like the rest of the world. Oracle employees AdExchanger spoke with requested anonymity.

The company also did not inform Oracle Data Cloud (ODC) employees ahead of the news, which was shared with investors during the company’s earnings conference call earlier this month.

“Before we discuss my guidance for the first quarter and fiscal year 2025, I would just like to share a few remarks with you,” said CEO Safra Catz. “The first is that [Q2]we decided to exit the advertising business, which had fallen to approximately $300 million in revenue in fiscal 2024.”

This information was not mentioned again during the call by an Oracle official or during the question-and-answer session with investors.

Oracle did not respond to repeated requests for comment.

The sparkle

In the day before Oracle’s announcement and immediately after the news, there was a flurry of pressure about getting rid of at least the Datalogix and BlueKai businesses, according to two former ODC sales executives and a current responsible for business development.

Subscribe

AdExchanger Daily

Get our editors’ roundup delivered to your inbox every weekday.

Apparently, there were no takers.

What’s puzzling is that Datalogix and BlueKai are perhaps the least profitable subsidiaries. Moat and Grapeshot, for example, are in the desirable categories. Moat has ceded its mindshare to IAS and DoubleVerify, but ad verification is an investment category and Moat still has a significant market position. Grapeshot remains a leading provider of contextual data and would be a significant shift, even if it wouldn’t come close to recouping the $400 million Oracle spent.

In addition to three executives close to Oracle who had only heard of Datalogix and BlueKai, AdExchanger spoke with two executives and/or venture capitalists at contextual advertising companies who likely would have gotten a call if Grapeshot had been put up for sale. They hadn’t heard anything like that.

All pieces, no puzzle

While its marketing cloud competitor Adobe has pivoted to media buying with TubeMogul, Oracle has presented a vision of measurement and analytics without any interest in media or ad buying.

To realize this vision, Oracle spent $1.3 billion to buy Moat and Grapeshot, which formed the building blocks of a post-cookie business model. Oracle also created LiveRamp’s only competing integration business: Oracle’s version was called OnRamp. All of these decisions made strategic sense.

Another smart move was to seek partnerships with social platforms. Oracle and Moat coveted early partnerships with YouTube and Snapchat, long before IAS and DoubleVerify focused on social platforms.

However, things quickly turned sour for ODC following the Cambridge Analytica scandal in 2018. Facebook responded by shutting down its third-party data seller marketplace, which included Datalogix’s data segments.

Three former employees independently called Facebook’s removal of third-party data vendors “the end of the process” for ODC.

From there, things went from bad to worse. Soon, Europe began implementing GDPR, which put Oracle’s third-party data business at risk. Audience data business AddThis left Europe in 2019 and was shut down completely last year. Crosscharts and other device graphics have become untenable in Europe and have now disappeared as an independent category.

ODC was the anchor tenant of third-party data marketplaces. And as with large department store chains, having a massive presence in malls across the country is a serious problem when malls close.

“The cost of ubiquity is high,” Eric Roza, Oracle’s senior vice president and general manager of its data cloud business, told AdExchanger in 2018. “We have hundreds of people in our organization focused solely on these integrations and partnerships.”

With the decline in third-party data marketplaces, this army of data sellers has made ODC a very costly investment for its overall revenue.

Sized

Even though ODC was feeling the headwinds of being the largest seller of ad tech data, it was still just a small fish in Oracle’s big ocean.

“Data vendors with interesting data sets would come to think they were going to make millions,” said one former ODC employee. People thought ODC had “Oracle money,” but in reality, the group was underfunded and couldn’t afford the best data vendors, he said.

Between 2018 and 2020, Oracle Advertising made a major push to surpass $1 billion in annual revenue in order to “get on Larry Ellison’s radar,” according to a former business development executive. Oracle Advertising’s revenue did indeed top $1 billion at its peak, according to some sources, though that’s a far cry from reports that Oracle Advertising would make more than $2 billion by 2022.

But with its core business of selling third-party data in decline, Oracle Advertising has become a risk without much reward.

For example, Oracle spent $28 billion on its acquisition of Cerner, a health technology company, in 2021. The company faced a huge backlash at the time, simply because it also operated the data brokerage and marketplace sales business.

A former ODC employee who left the company since the Cerner acquisition told AdExchanger that the new healthcare business faced endless setbacks and delays from the start, as many new partners in the healthcare industry categorically assumed that the data would find its way to Oracle’s advertising marketplace.

From this perspective, one could understand why Oracle and its investors were happy to push ODC out of a moving vehicle.

Oracle Advertising has also become an unsustainable regulatory risk. If Oracle were to be fined under GDPR, for example, it is likely that ODC and its data marketplaces would suffer, according to numerous sources who have handled the company’s internal legal matters.

In 2023, Oracle Advertising was a rapidly declining company with total profits of $300 million. But it put Oracle in the crosshairs of a potential multibillion-dollar fine, if it were the target of a GDPR investigation. This is all hypothetical, but it is also something that company leaders need to be prepared for hypothetically.

What happens next?

The closure of Oracle Data Cloud shocked the industry, as it is rare for large, valuable assets to simply disappear.

“I’ve never seen this before,” said a longtime programmatic data seller who was part of ODC when it was founded.

When Sizmek went bankrupt, its Frankenstein product set was dismantled and the Peer39 contextual business was pulled and sold. Grapeshot is a much larger company with all sorts of IP structures and entire data classifications that are unique to its publisher footprint. This would be an eminently desirable acquisition.

There is no solid or satisfactory reason why Grapeshot, Moat and other businesses should not be sold, especially since they exist as standalone groups internally and retain their brands. Oracle investors did not press the reasons or terms of the decision, and Oracle’s public relations department did not respond to requests for comment.

The end result is an expectant feeding frenzy.

IAS and DoubleVerify are the net winners, since they can pick up Moat customers who want to jump ship before Oracle shuts down the company. Moat employees are already being poached and approached, sources said. Contextual providers are also in the running now, not for Grapeshot’s direct business but for key employees, according to executives at two other competitors in the contextual data space.

LiveRamp is also a big winner, as OnRamp is on the launch pad. Experian launched a third-party data integration business just two weeks ago, which seems prescient as much of that market will now be ceded by Oracle.

The $300 million Oracle Advertising made last year is a pittance for Oracle. But those crumbs are a feast for the programmatic ecosystem.

“I just feel bad for the people at ODC who stayed,” said a former colleague who left years ago, discouraged by Oracle’s lack of investment in the company.

Some believe these Oraclers were hanging around and easily collecting a paycheck, he said. But as proven by the eagerness of programmatic solution providers to fill the void Oracle left in the market, the opportunity existed to turn these disparate pieces into a whirring data machine.

“A lot of people stayed because they really understood that vision and they tried to make it happen,” he said. “Until they discovered it.”