The artificial intelligence (AI) market boom in early 2023 came just when tech stocks needed it most. Companies were struggling with the aftermath of an economic slowdown the year before, leading investors to invest more in AI. Nasdaq-100 Technology Sector The index is expected to fall by 40% in 2022. However, the launch of OpenAI’s ChatGPT seems to have breathed new life into the sector and reminded investors of the vast growth potential of tech stocks. As a result, the same index has climbed by 88% since January 1, 2023.

Tech companies have jumped into artificial intelligence, a sector that is expected to reach nearly $2 trillion in spending by the end of the decade. This generative technology has the potential to boost countless industries as demand for AI services and the chips that make them possible soars.

Despite this explosion of growth over the past 18 months, it’s not too late to invest in the market and take advantage of its long-term development. Here are two AI stocks to buy in July.

1. Intel

Intel (NASDAQ:INTC) was slightly overlooked in the middle of the AI rally. While rivals like Nvidia (NASDAQ: NVDA) And Advanced microsystems (NASDAQ:AMD) While Intel shares are up 745% and 144% since the start of last year, Intel’s stock price is up a more moderate 18%. A series of challenges over the past decade have worn on Wall Street, including losing market share in the chip industry and the end of a lucrative partnership with Apple.

However, Intel has announced significant structural changes to its business model over the past year that could trigger a change in fortunes for the chipmaker. The company is now focusing on two high-growth markets: AI and manufacturing. As a result, Intel unveiled its Gaudi 3 AI accelerators this year, which are cheaper than Nvidia’s and offer similar performance.

At the same time, the company is building chip manufacturing plants across the country, aiming to reclaim the top spot in the manufacturing sector and become the country’s largest chip manufacturing plant. The move could allow Intel to tap into the growing demand for chips in the market as companies like Nvidia and AMD outsource their production.

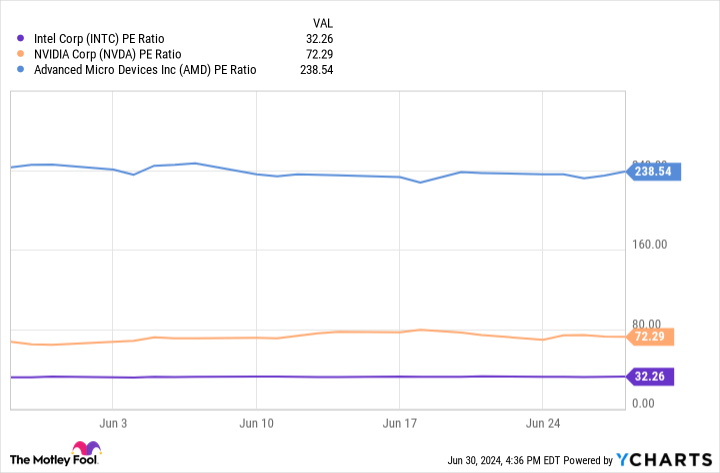

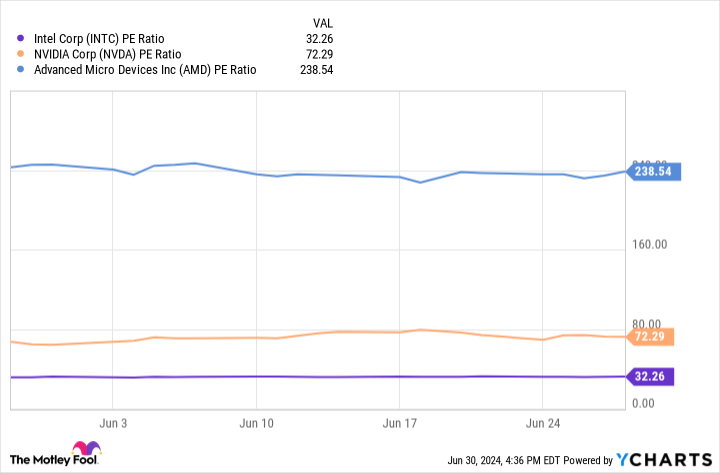

Additionally, the data in the table above shows that Intel stock is a bargain compared to its competitors. Its significantly lower price-to-earnings (PE) ratio suggests that its stock offers much more value, making it a no-brainer in July.

2. Alphabet

Like Intel, Alphabet‘s (NASDAQ: GOOG) (NASDAQ: GOOGL) The stock is trading at a significant premium to its competitors. The company is in strong competition with cloud giants Microsoft (NASDAQ: MSFT) And Amazon (NASDAQ: AMZN) Artificial intelligence has boosted the entire industry. Alphabet has the third largest market share in cloud computing (after Microsoft and Amazon), but is quickly catching up.

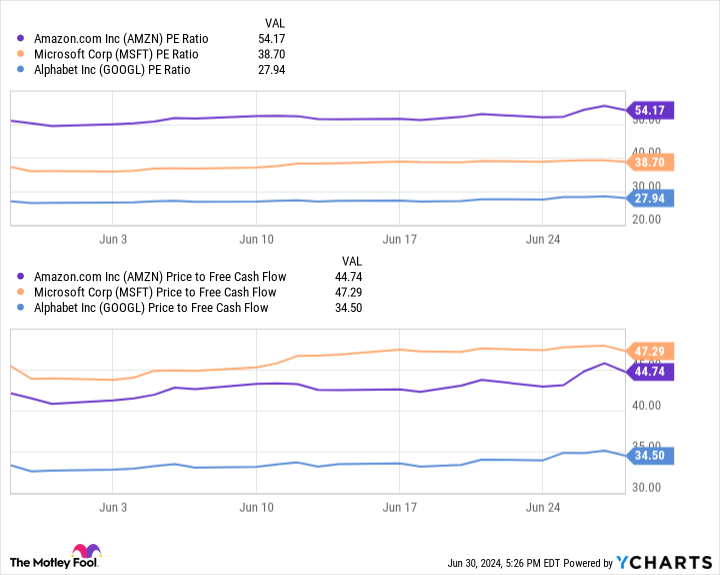

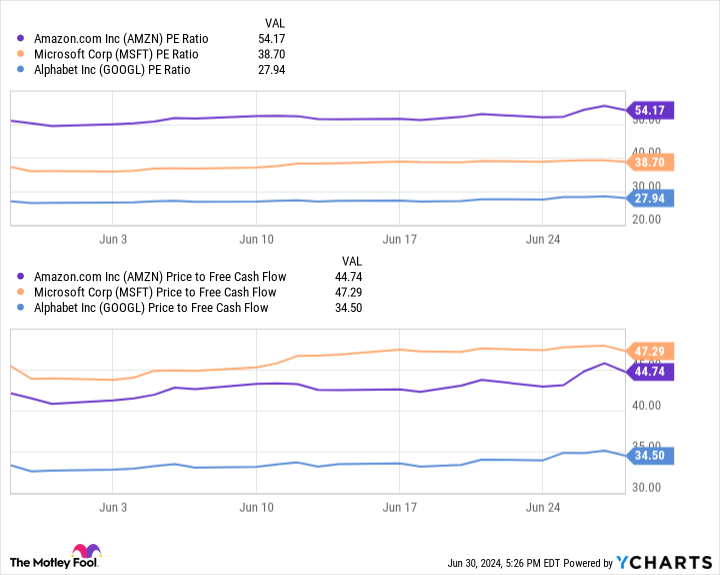

The chart below shows that Alphabet stock potentially offers much better value than its competitors. Google’s lower price-to-free cash flow and P/E ratios suggest that Alphabet could be one of the best-valued stocks in the AI sector.

Alphabet’s revenue rose 15% year over year to $81 billion in the first quarter of 2024, beating analyst expectations by nearly $2 billion. The company benefited from a 14% increase in Google Services revenue and a 28% increase in Google Cloud sales. Alphabet’s cloud revenue growth is particularly impressive, as it beat Microsoft’s Azure and Amazon Web Services in cloud growth for the quarter, with those platforms growing 21% and 17% year over year.

Cloud computing has become a key growth area in AI as companies increasingly use cloud services to integrate the technology into their workflows. As a result, Alphabet has invested heavily in expanding its AI offerings over the past year, introducing new tools in Google Cloud, adding generative features to Google Search, and improving its advertising services.

Alphabet has reached $69 billion in free cash flow this year, which only strengthens the case for its stock. This figure suggests that the tech giant has the financial resources to continue investing in its business and keep up with its rivals. That, combined with its bargain price, makes Alphabet a stock to buy all the time this month.

Should You Invest $1,000 in Intel Right Now?

Before you buy Intel stock, consider this:

THE Motley Fool, Securities Advisor The team of analysts has just identified what they believe to be the 10 best stocks Investors Should Buy Now…and Intel Isn’t One of Them. These 10 Stocks Could Deliver Monster Returns in the Years to Come.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $761,658!*

Securities Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building advice, regular analyst updates and two new stock picks each month. Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

See all 10 actions »

*Stock Advisor returns as of July 2, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long Intel January 2025 $45 calls, long Microsoft January 2026 $395 calls, short Intel August 2024 $35 calls, and short Microsoft January 2026 $405 calls. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks to Buy in July was originally published by The Motley Fool