Top line

SoftBank shares hit an all-time high on Wednesday, signaling renewed confidence in the popular tech company amid growing investor interest in artificial intelligence after founder and CEO Masayoshi Son unveiled plans to make aggressive moves in the sector and invest heavily in AI and chip companies.

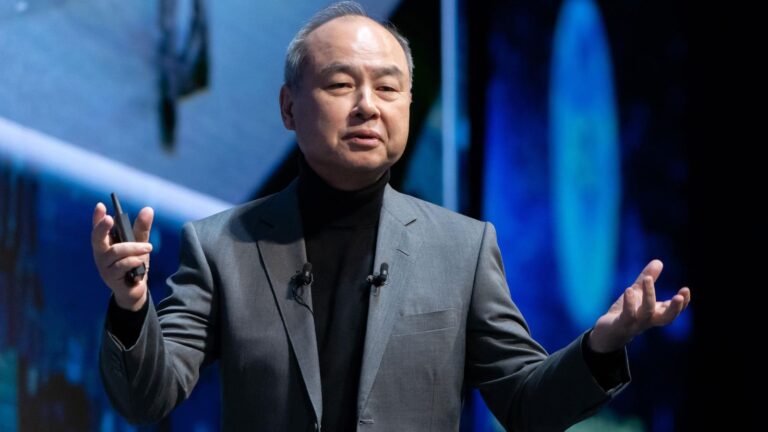

SoftBank Group CEO Masayoshi Son said the company would bet big on AI and computer chips.

Highlights

Shares of SoftBank Group rose 1.5% during regular trading hours in Tokyo on Wednesday.

The shares were trading at ¥10,705.00 (about $66) per share at market close, an all-time high for the investment firm.

Part of SoftBank’s rise can be attributed to the recovery in the benchmark Nikkei 225 index, Tomoaki Kawasaki, senior analyst at IwaiCosmo Securities, told Bloomberg.

However, Kawasaki said the investment firm has also benefited from its growing reputation among investors as a “semiconductor-related stock.”

Semiconductors, or computer chips, are essential to running and developing powerful generative AI software, and the industry has seen explosive growth alongside growing interest in AI tools like OpenAI’s ChatGPT, Google’s Gemini and Anthropic’s Claude.

The rally also signals broad confidence in the vision of SoftBank founder and CEO Masayoshi Son, who told shareholders last month that the company would make a foray into AI that would make previous investments look like a “warm-up,” citing AI chips, robotics, autonomous driving and data centers as key areas for investment.

Forbes Rating

Son, who is part of SoftBank, has increased his fortune by nearly $600 million, or about 1.7 percent, over the past day and his net worth now stands at about $34.1 billion. Son’s wealth, which comes largely from his stake in the tech investment giant, makes him the 48th richest person in the world and the second richest person in Japan, about $3 billion behind clothing billionaire Tadashi Yanai.

Key context

SoftBank holds a legendary place among tech investors, and Son was widely regarded as a visionary by many in the industry. The Japanese tech investment giant has made some of the most successful bets in history, including a particularly lucrative investment in China’s Alibaba. In recent years, however, the firm’s reputation has been tarnished by several high-profile missteps at its flagship Vision Fund. Among them was the sale of a 5% stake in chipmaker Nvidia five years ago, which is now reportedly worth about $160 billion, which Son says he regrets. The firm declared itself “in defense mode” several years ago to regroup, but recently vowed to go back on the offensive with AI and computer chips to capitalize on the AI boom. Son says SoftBank’s AI strategy will focus on semiconductor company Arm, a chipmaking giant in which it owns a majority stake.

What should you pay attention to?

SoftBank has reportedly set its sights on British artificial intelligence company Graphcore, although any takeover could be blocked by a national security investigation by the British government. The sale of key artificial intelligence technologies, such as semiconductor chips, is increasingly viewed as a national security issue by governments around the world, given their growing importance to defense and critical infrastructure, as well as other areas of strategic importance.

Crucial Quote

Last month, SoftBank founder Son said he believed his mission in life was to usher in an era of artificial superintelligence where AI is 10,000 times smarter than humans, a return to the kind of bold talk the founder was known for in the past. “This is what I was born to do, to make AI happen,” he said, placing the AI vision at the center of SoftBank’s future operations. “Look at me, I’m going to make it happen.”

Get Forbes Breaking News SMS Alerts: We send you SMS alerts so you’re always up to date on the biggest stories making headlines today. Text “Alerts” to (201) 335-0739 or sign up here.

Further reading