Two federal judges in Kansas and Missouri on Monday blocked President Joe Biden’s administration from further implementing a new student loan relief plan that would ease payment obligations, at the urging of several Republican-led states.

Bloomberg | Bloomberg | Getty Images

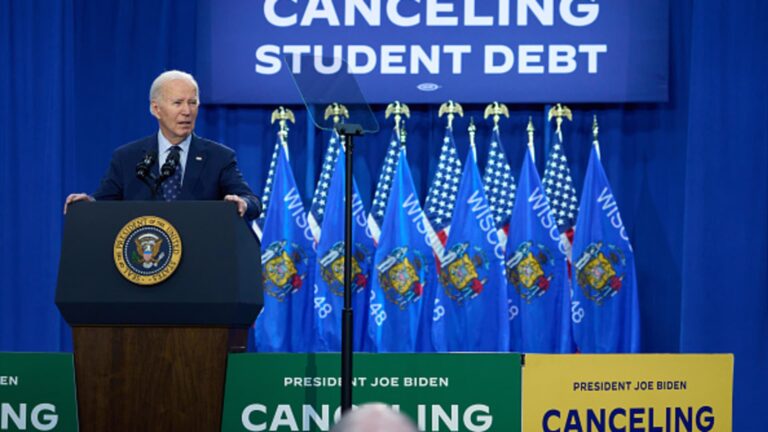

President Joe Biden may try to forgive the debt of millions of federal student loan borrowers just weeks before voters decide between him and former President Donald Trump at the November ballot box.

In the Biden Administration’s Spring 2024 Unified Agenda, the U.S. Department of Education revealed that it will publish a final rule on student loan relief sometime in October.

Higher education expert Mark Kantrowitz said the timeline for regulatory changes would normally mean the administration wouldn’t be able to implement the program until July 2025. But he noted the department could act sooner by simply publishing a notice in the Federal Register.

More information on personal finance:

Experts say the right mix of retirement accounts could help reduce future taxes.

Biden reelection uncertainty could be problematic for student loan borrowers

Federal Judge Partially Blocks FTC Anti-Compete: What it Means for Workers

“I look forward to the publication [of the rule] “With the vote scheduled for early October, the conflict between Democrats and Republicans over student loan forgiveness will likely continue to have an impact during the election,” Kantrowitz said.

An Education Department spokesman said the Biden administration has already made historic reforms to a “broken student loan system.”

“The current administration is committed to providing relief to as many borrowers as possible as quickly as possible, and these regulatory efforts will help provide financial relief to tens of millions more borrowers,” they said.

Loan forgiveness is a hotly partisan issue

Conservatives are typically He questions the fairness of forgiving the debts of those who have benefited from higher education and then having taxpayers foot the bill. Kantrowitz estimates that just over a third of Americans over the age of 25 have a bachelor’s degree.

“We are proud to stand with taxpayers in calling on the Biden Administration to abandon a plan that would burden all Americans with the debt of a few, something the Supreme Court has already found to be unconstitutional,” said Ryan Walker, vice president of Heritage Action for America.

“Biden’s latest debt-shifting ploy is an illegal and unfair election-year ploy that has backfired and should cost him at the polls,” Walker said.

Nearly half of voters (48%) say student loan forgiveness is an important issue in the 2024 presidential and congressional elections, according to a recent survey by research and consulting firm Socialsphere, which surveyed 3,812 registered voters, including 2,601 Gen Z and millennials, conducted March 15-19.

Additionally, 70% of Gen Z respondents said this behavior is “very” or “somewhat” important in the election, along with 72% of Black voters and 68% of Hispanic voters surveyed.

Many younger conservatives also support student loan forgiveness, with 49% of Gen Z and millennial Republicans surveyed saying some or all of outstanding student loan debt should be wiped out.

As president, Trump has called for the elimination of existing loan relief programs at the U.S. Department of Education, including the popular Public Service Loan Forgiveness program. He also wants to cut the department’s budget, and his administration has halted a regulation aimed at forgiving loans for people who were defrauded by their schools.

Trump, who is running for president again, appears poised to make even deeper cuts to student financial aid programs. He has repeatedly attacked Biden’s loan relief policies and said in a campaign video late in 2023 that he wanted to shut down the Department of Education entirely.

Republicans may try again to block the rescue plan

To critics of broad student loan forgiveness, Biden’s new plan sounds a lot like the original.

After Biden touted the revamped relief program, Republican Missouri Attorney General Andrew Bailey I wrote to X The president is “brazenly trying to ignore the Constitution.”

“See you in court,” Bailey wrote.

Missouri was one of six Republican-led states, along with Arkansas, Iowa, Kansas, Nebraska and South Carolina, that filed lawsuits against President Biden’s first comprehensive debt relief package.

Republican states argued that the president had overstepped his authority and that forgiveness would hurt lenders’ profits, and the conservative Supreme Court justices agreed with them.

Kantrowitz said further legal battles will be inevitable once the Biden administration announces a new student loan forgiveness plan in October.

“Once the final rule is published, there will likely be lawsuits filed immediately trying to block it,” he said.

A recent Supreme Court decision could make it even harder for Biden’s revised plan to withstand such an onslaught.

The Supreme Court in late June overturned the so-called Chevron rule, a 40-year-old precedent that required judges to defer to federal agencies’ interpretations of contested laws. The 6-3 decision, which split the conservative-majority court along ideological lines, is expected to weaken the federal government’s regulatory power.