Premium travel returns to pre-pandemic levels

In the first quarter of 2024, premium travel roughly matched pre-pandemic levels in terms of both traffic and revenue.

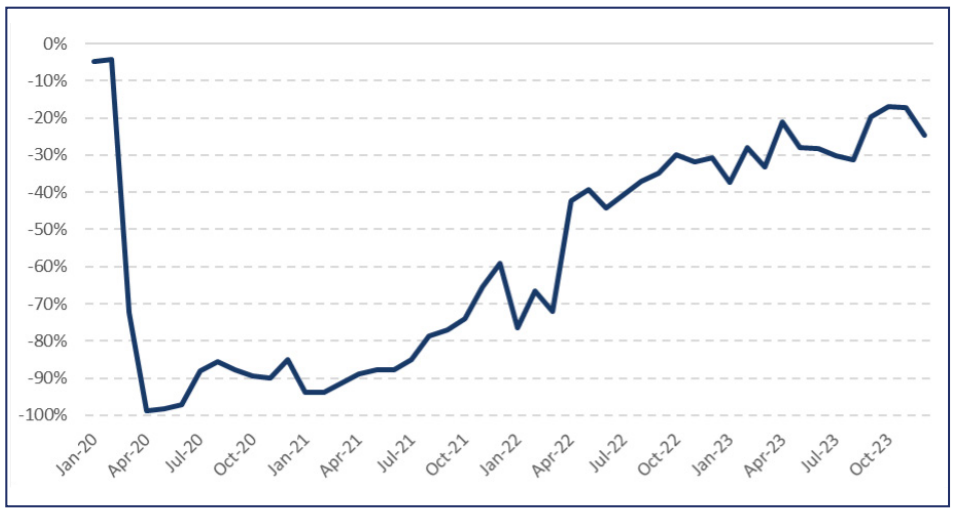

While premium travel is now returning to “normal” levels, the recovery since the COVID-19 pandemic has been uneven, both in pace and geography.

The initial recovery in premium cabins has lagged significantly behind the overall recovery in air travel throughout 2020 and early 2021.

Corporate travelers, typically premium cabins’ most important market, have been stranded during this period, a result of a combination of border closures, concerns about employee health and safety, drastic cuts in travel budgets by many industries and the widespread adoption of video conferencing technology.

As business travel fell, airlines responded by slashing fares for premium cabins.

According to IATA, premium cabin fares fell by more than 70% worldwide through July 2020. By comparison, economy cabin fares fell by about 30% at the same point in time.

Lower fares have expanded the appeal of premium cabins to more price-sensitive market segments, most notably among leisure travelers who primarily preferred economy cabins for vacations and other trips.

Some in the leisure market have chosen to upgrade to more luxurious accommodations as the pandemic has led to increased savings, wage increases and the inability to travel internationally due to the pandemic.

This is part of a broader “revenge travel” trend that has broadly aligned the recovery of premium and economy class travel by early 2022.

Airfares have returned to normal, both in nominal terms and the price spread between premium and economy cabins, and the revenge travel phenomenon has faded, although there are signs that some travelers remain willing to choose to travel in premium cabins.

The “new normal” for business travel?

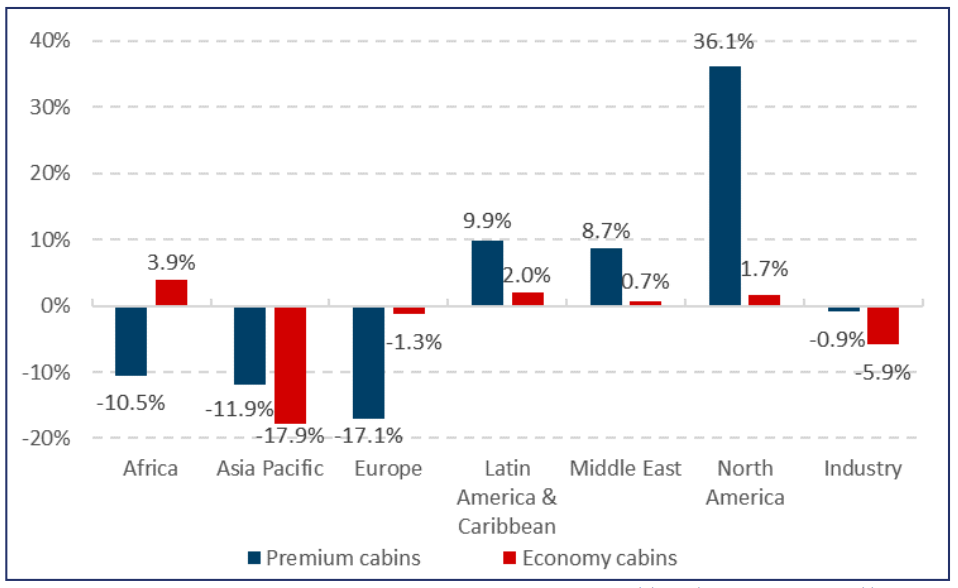

While premium travel is returning to “normal” globally, there remains significant variation in premium class traffic, both by travel purpose and between world regions.

Business travel volumes remain broadly below pre-pandemic levels and spending continues to recover at different paces across industries, with construction, education and professional, scientific and technical activities proving the most resilient throughout the recovery.

The Global Business Travel Association reports that inflation is driving growth in business travel spending faster than the frequency (volume) of business trips. Business travelers are choosing different air classes and hotel types, and telecommuting and blended travel are on the rise.

Additionally, with the widespread adoption of conferencing technology, the rapid increase in remote working and the rise in multi-modal business travel, sustainability initiatives are receiving increased attention from stakeholders across the business travel ecosystem.

These trends are likely to impact business travel productivity and its composition.

Premium travel is trending strong again

Business travel has not suffered the large structural decline that some had feared would result from the pandemic, and while corporate travel volumes still lag well behind the overall recovery, particularly in the Asia-Pacific region, there are reasons for optimism about the overall business travel outlook.

Across 14 countries surveyed (including the US, UK, Australia, Japan, Spain and South Africa), business traveller arrivals reached 75% of pre-pandemic levels at the end of 2023.

However, corporate travel spending is now approaching pre-pandemic levels (though the recovery is less optimistic when inflation is taken into account) and the outlook for travel volumes is steadily improving.

Hybrid and remote working trends are also creating demand for new types of business travelers and new kinds of business travel.

At the same time, traditional forms of corporate travel, both client-facing and internal, are gradually making a comeback, supported by a broader recovery in economic activity and a rebound in corporate travel budgets.

Overall, premium travel appears to be thriving again.

New CAPA Report: Premium Travel – Top 10 Global Routes for 2024

CAPA’s new report “Premium Travel – Top 10 Routes Globally 2024” provides an in-depth analysis of premium travel trends around the world, focusing on the top 10 routes in the world for premium seating. Each list includes detailed commentary on the performance of the route pair.