NVIDIA It has been of Artificial intelligence (AI) stocks to own from the past year and a half. But the hopes pinned on this stock are outrageous and could spell disaster in the future.

But AI is here to stay, and if you’re considering investing in this space, we recommend considering these stocks before considering Nvidia.

Taiwan Semiconductor

Taiwan Semiconductor Manufacturing (NYSE:TSM) The company makes many of the chips in all the devices that power the incredible AI technology we use today, and Nvidia’s GPUs are packed with TSMC products, so the company benefits from their performance.

Another big customer is applerecently announced that AI features will only be available on its latest generation of smartphones, which could spark a wave of massive refreshes that could benefit Taiwan Semiconductor immensely.

In any event, management expects AI-related revenues to grow 50% annually over the next five years, with the segment accounting for more than 20% of total sales. Over the longer term, management expects total revenues to grow 15% to 20%, which should result in significant outperformance against the market.

Taiwan Semiconductor’s stock price has seen impressive gains this year (up over 75%), and I believe this gains will continue for years to come as the company’s products integrate into a world where AI capabilities are only just scratching the surface.

alphabet

alphabet (Nasdaq: GOOG) (Nasdaq: GOOGL) Amazon.com Inc., the parent company of Google, has long been a proponent of AI. It seemed caught off guard by a surge in the popularity of generative AI in late 2022, but has since corrected that misstep with a recent announcement that saw its Gemini model emerge as a top pick.

Alphabet is also integrating AI into various advertising products to help advertisers create effective campaigns and allow its internal models to match the right ads to viewers. While these launches haven’t directly translated into significant revenue growth, they have solidified Alphabet’s top position among where advertisers need to spend their money.

While Alphabet isn’t as flashy an investment as Nvidia, its dividends, aggressive share repurchase plan, and steady growth will ensure it consistently outperforms the market by a few percentage points each year.

The stock trades at about 25 times forward earnings, which isn’t historically cheap, but it is significantly cheaper than many of its peers.

Salesforce

Salesforce (NYSE: CRM) is a bit of a backdoor choice, as it’s a customer relationship management software company. But the company is actively pushing AI models to its clients as a way to improve their business. Because it relies heavily on in-house customer data, it can integrate it in-house to provide employees with the best possible information when completing a sale. It can also create AI chatbots that deliver better customer service interactions than traditional methods.

Given Salesforce’s market position, getting this AI offering right will be key to maintaining its dominance, and it will also provide another avenue of growth for the company as revenue growth remains in the high single digits and the company’s maturity becomes evident.

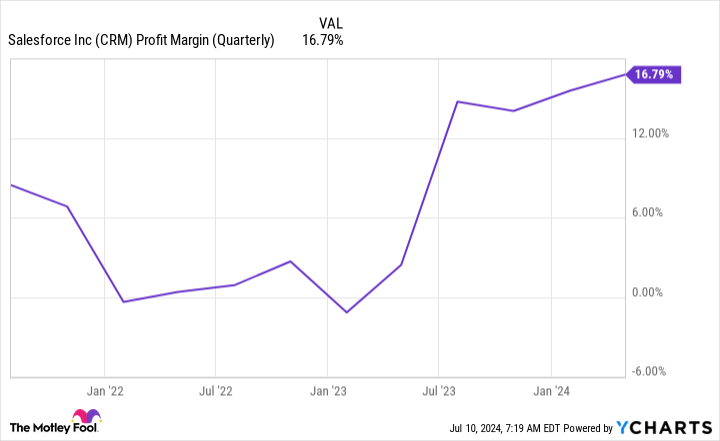

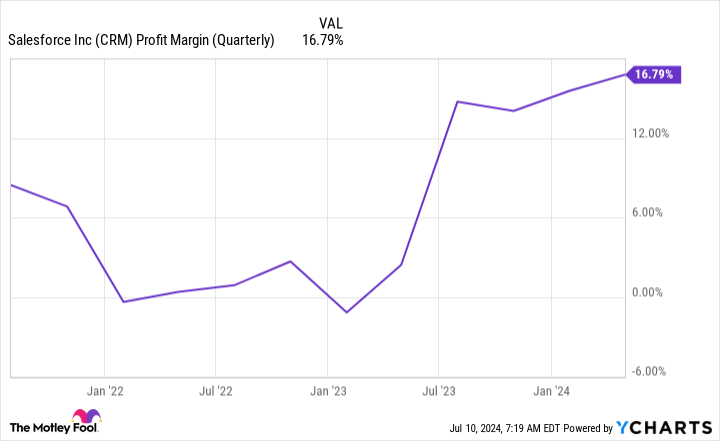

However, it only recently started paying dividends, and it has a long way to go before it reaches peak profit margins for software companies (the gold standard is Adobe30% margin).

Putting all this together, this stock has the potential to grow significantly going forward and could become a market-beating stock over the long term.

All three of these companies are more stable than Nvidia, which has shown cyclical nature ever since its inception. If you’re looking for stocks with more affordable prices and high growth potential, Alphabet, Taiwan Semiconductor, and Salesforce are wise choices.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before buying Taiwan Semiconductor Manufacturing shares, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now: Taiwan Semiconductor Manufacturing Co. Ltd. was not included. The 10 stocks selected have the potential to generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, $791,929!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of July 8, 2024

Suzanne Frey, an Alphabet executive, serves on The Motley Fool’s board of directors. Keithen Drury has invested in Adobe, Alphabet, Salesforce, and Taiwan Semiconductor Manufacturing. The Motley Fool has invested in and recommends Adobe, Alphabet, Apple, Nvidia, Salesforce, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

“Forget Nvidia: 3 Artificial Intelligence (AI) Stocks to Buy Now” was originally published by The Motley Fool.