The semiconductor industry has been rebounding this year due to increased demand for chips for a variety of applications including smartphones, personal computers (PCs), data centers, etc. But there is one particular niche within the industry that is experiencing greater growth than the overall semiconductor market.

The Semiconductor Industry Association predicts that the global semiconductor market will record revenue growth of 16% this year. However, the memory chip market is expected to record much faster growth than the semiconductor market. Market research firm Gartner The company expects memory spending to increase 66% this year.

Micron Technology The company is benefiting greatly from surging memory sales, as evidenced by its latest quarterly earnings. Shares of the memory specialist are up 54% through 2024 and could rise even more if growth accelerates. But there’s another memory stock that’s up a healthy 42% so far this year, which could be a big tailwind for it when it reports quarterly earnings later this month. Lam Research (Nasdaq:LRCX).

Let’s see why.

Artificial intelligence will drive memory demand

During the company’s latest earnings call, Micron Technology executives noted that demand is surging for the memory found in their artificial intelligence (AI) chips, known as high-bandwidth memory (HBM). More specifically, Micron executives noted that its HBM capacity is “sold out for 2024 and 2025, with most of the pricing for 2025 already contracted.”

The company expects HBM revenue to grow from “hundreds of millions of dollars” in fiscal 2024 to “billions of dollars” in fiscal 2025. Such robust demand for HBM explains why memory makers such as Micron are looking to expand their production capacity. For example, Micron peer SK Hynix has commissioned the construction of a new facility to accommodate surging HBM demand.

A similar scenario is set to play out at Samsung, with Hynix expecting its HBM capacity to more than double in 2024. Moreover, Samsung expects to double its HBM capacity again in 2025. This all bodes well for Lam Research, which derives most of its revenue from selling memory manufacturing equipment.

More specifically, 44% of Ram’s revenue comes from the sale of memory equipment, so strong demand for memory chips should translate into more business for Ram, which is why the company plans to report year-over-year growth when it reports quarterly results this month.

Lam Research’s growth recovery could lead to further gains

Lam Research expects revenue of $3.8 billion for the quarter ending June 30, which is also the final quarter of its fiscal 2024, up 19% from a year ago. By comparison, Ram’s revenue for the first nine months of its fiscal 2024 was $11 billion, down 22% from a year ago. The company struggled last year due to a memory industry glut caused by weak demand for smartphones and PCs.

But with the advent of AI, these two markets are set to turn around. Sales of AI-enabled smartphones and PCs are expected to grow exponentially over the next few years, which should require more memory chips. For example, Micron notes that this year’s AI smartphones will have a 50% to 100% increase in memory capacity compared to last year’s models. Meanwhile, DRAM (dynamic random access memory) capacity for AI-enabled PCs is expected to increase by 40% to 80%.

According to industry group SEMI, spending on DRAM memory equipment is expected to grow at a compound annual growth rate of 17% through 2027, which is no surprise. Meanwhile, spending on NAND flash storage is likely to grow at an even more impressive rate of 29% over the same period.

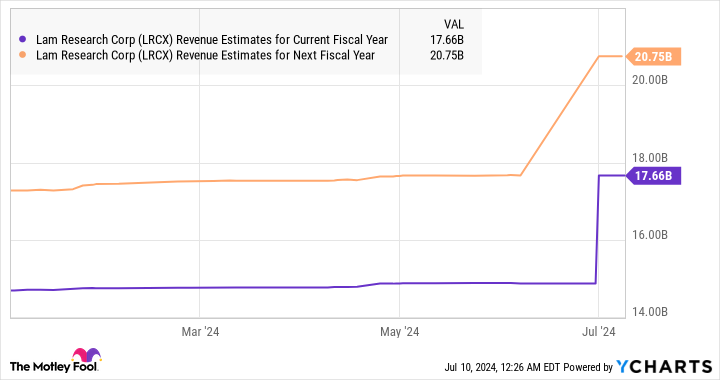

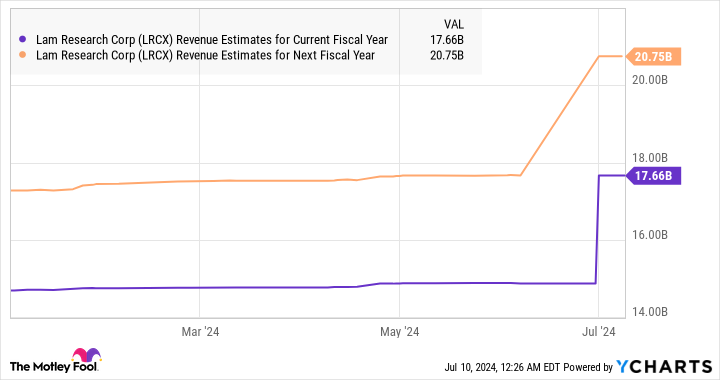

All of this explains why analysts expect Lam Research to report healthy growth starting in its just-started fiscal year 2025. Lam Research’s fiscal year 2024 revenue forecast is $14.9 billion, indicating a 15% decline year-over-year.

Wall Street may reward Ram’s accelerating growth with a higher stock price, especially if the company reports solid earnings later this month. Trends in the memory market suggest that Ram can indeed deliver stellar results that exceed expectations. The company’s guidance could also be firmer as spending on memory equipment could surge.

Therefore, now may be a good time to buy this AI stock, as its upcoming quarterly report could provide some impetus for the company’s share price.

Should you invest $1,000 in Lam Research right now?

Before buying Lam Research shares, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now… Lam Research wasn’t among them. The 10 stocks selected could generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, $791,929!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of July 8, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has invested in and recommends Lam Research. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

Up 42% in 2024, This Artificial Intelligence (AI) Stock is Set for Big Gains in July This was originally published by The Motley Fool.