Surging demand for artificial intelligence chips will drive gains for several semiconductor stocks this year, according to JPMorgan.

“We continue to believe we are at the beginning of a multi-quarter semiconductor upswing and that companies should be able to deliver strong results in the second half of the year,” he said. [second half of year]”The strong demand from enterprises and cloud computing providers to build out AI infrastructure is driving demand,” analyst Harlan Sah wrote on Monday.

He expects most semiconductor companies to report second-quarter profits slightly above analysts’ average estimate and to provide better-than-expected guidance for the next quarter.

Sah said his top chip stock idea was Broadcom.

,

Marvel Technology, Micron Technology

,

Analog Devices

,

Microchip Technology

.

He gives all five stocks an Overweight rating.

“Custom AI ASIC [application specific integrated circuits]”We continue to expect a strong and growing customer adoption/design order pipeline from Broadcom and Marvell,” he wrote.

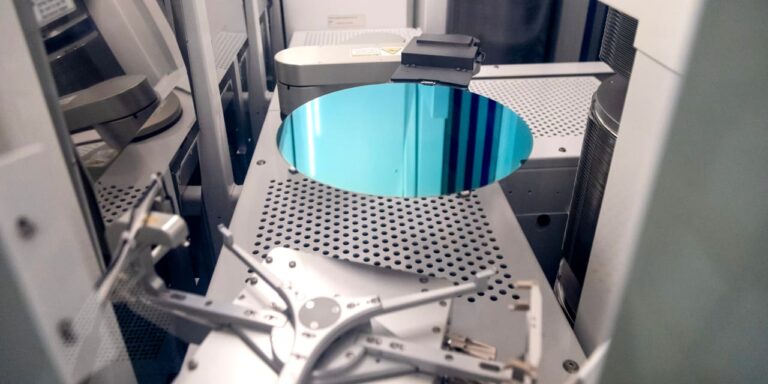

Micron leads the market for DRAM, used in desktop computers and servers, and flash memory, used in smartphones and solid-state hard drives. The memory chip maker supplies high-bandwidth memory (HBM) 3E chips for some of NVIDIA’s products.

of

Data Center AI Products.

Advertisement – Scroll to continue

As for auto and industrial semiconductor suppliers, including Analog Devices and Microchip, Sah expects demand trends to improve after the June quarter. “We expect the first half of 2024 to be the trough for most of the companies we cover (e.g., ADI, TXN, MCHP),” Sah wrote.

In trading on Monday, Broadcom shares rose 1% to $171.72, Marvell shares rose 0.7% to $74.07 and Micron shares were down 0.9% to $132.39. Analog Devices shares were down slightly to $238.34 and Microchip shares rose 0.2% to $92.82.

Email Tae Kim at tae.kim@barrons.com