plural CVS Health Corporation (NYSE:CVS) insiders have sold a significant amount of shares in the past year, which may have raised some eyebrows among investors. When assessing insider transactions, knowing if insiders are buying is usually more useful than knowing if they’re selling, as the latter can be interpreted in different ways. However, if multiple insiders are selling shares in a particular period, shareholders should look more closely.

While insider trading is not the most important thing when it comes to long term investing, we think it is entirely logical to keep an eye on insider activity.

View our latest analysis for CVS Health

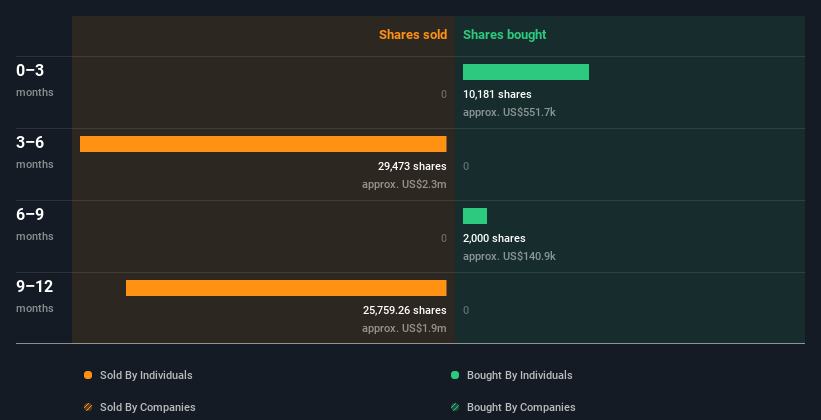

CVS Health insider transactions over the past year

We can see that the biggest insider sale in the past year was by Executive VP Prem Shah, who sold US$2.3m worth of shares at approximately US$76.95 per share. While insider selling is generally not a good thing, it would be more concerning if the sale happened at a lower price. We can take some comfort in knowing that this sale happened at a price significantly above the current share price of US$59.57, so it may not tell us anything about how insiders feel about the current share price.

In the last 12 months, insiders bought 12,180 shares for US$695,000, but sold 55,230 shares for US$4.2 million. Insider sales of CVS Health shares have outweighed purchases over the past year. You can see insider transactions (by companies and individuals) over the past year in the chart below: You can click on the chart below to see the exact details of each insider transaction.

For those who love to find Hidden gem this free This free list of small and mid-cap companies with recent insider buying could be just the thing for you.

CVS Health insiders recently bought shares

Over the past quarter, CVS Health insiders have spent a fair amount on the stock. In total, insiders bought US$554k worth of shares in the period, and no sales were recorded. This is a positive for us as it indicates some confidence.

Does CVS Health boast high insider ownership?

For common shareholders, it is worth checking how many shares are held by company insiders. High insider ownership tends to make company management more mindful of shareholder interests. CVS Health insiders own 0.1% of the company, worth about US$113m. Seeing this level of insider ownership increases the likelihood that management has shareholder interests in mind.

So what does CVS Health’s insider trading indicate?

Recent insider purchases are certainly a positive thing. However, the same cannot be said about transactions over the past 12 months. High insider ownership, along with recent purchases by some insiders, suggests they are well aligned and optimistic. In addition to knowing about ongoing insider transactions, it is useful to identify the risks facing CVS Health. For example: 1 warning sign for CVS Health You should know.

If you want to check out another company that may be financially superior, don’t miss this one. free A list of interesting companies with high return on equity and low debt.

For the purposes of this article, insiders are individuals who report their transactions to the relevant regulatory body. Currently, we count only open market transactions and private dispositions of direct interests, not derivative transactions or indirect interests.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Contact us directly. Or email us at editorial-team@simplywallst.com