Silicon Valley investors and Wall Street analysts are increasingly sounding the alarm about the billions of dollars being poured into AI, warning that overconfidence could lead to a huge bubble.

As The Washington Post Investment bankers are reportedly taking a very different view from last year’s fuss over AI, and are instead becoming wary of whether Big Tech can actually turn the technology into a profitable business.

“Despite the high price tag, the technology is nowhere near what’s needed for practical use,” Jim Covello, top equity analyst at Goldman Sachs, wrote in a report last month. “Building too much of something that the world doesn’t need or isn’t ready for usually ends badly.”

Earlier this week, Google reported second-quarter earnings that failed to impress investors due to thin margins and skyrocketing costs associated with training AI models, with capital expenditures soaring far beyond what the company was used to spending on them. The Wall Street Journal Total spending this year is expected to exceed $49 billion, 84 percent higher than the company’s average over the past five years, according to the report.

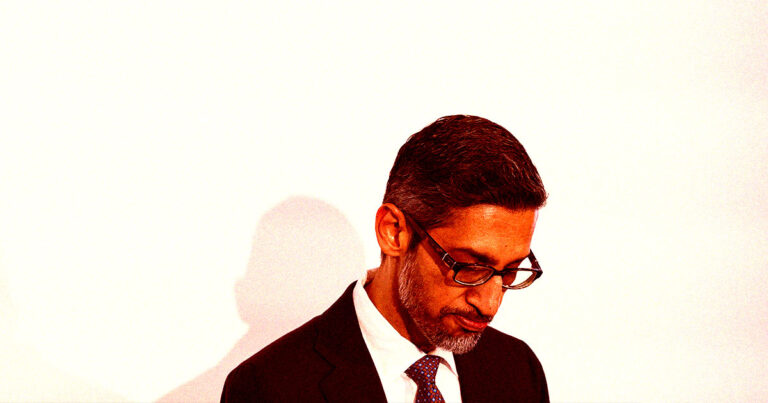

However, Google CEO Sundar Pichai remains adamant, arguing that “the risks to us of underinvesting are far greater than the risks of overinvesting.”

“There are much more significant drawbacks to not investing to lead here,” Pichai told investors on Tuesday.

Sure, the tech giant has deep pockets, but that $49 billion in profits will be much harder to capture: The AI market is still flooded with mostly free products, and the technology costs a lot of money to operate but doesn’t bring in much profit.

As a result, Google faces similar challenges to Microsoft and Meta, which are devoting huge portions of their available resources to AI without a clear monetization plan.

Investors are expected to pour $60 billion a year into developing AI models, according to Barclays analysts, enough to develop 12,000 products roughly the same size as OpenAI’s ChatGPT.

But whether the world needs 12,000 ChatGPT chatbots remains questionable at best.

“We expect many new services, but probably not 12,000,” Barclays analysts wrote in a note. The Washington Post“I feel Wall Street is becoming more and more skeptical.”

Experts have long expressed concern about a growing AI bubble, likening it to the dot-com crisis of the late 1990s.

“Capital continues to flow into the AI sector with little attention to company fundamentals,” tech stock analyst Richard Windsor wrote in a March research note. “Clearly, when the music stops, there won’t be many open seats.”

“This is exactly what happened with the internet in 1999, self-driving cars in 2017, and now generative AI in 2024,” he added.

In a blog post last month, Sequoia Capital partner David Kahn argued that the entire tech industry needs to make $600 billion a year to survive.

“Speculation is part of technology and there’s nothing to be afraid of,” he said, but he argued that AI technology is far from a “get rich quick” scheme.

But that doesn’t mean he’s entirely pessimistic.

“The reality is that it will be a long road ahead,” Kahn wrote. “There will be ups and downs, but it will undoubtedly be worth it.”

But it remains to be seen whether AI chatbots like ChatGPT will transform into cash-printing machines that will recoup these huge investments. For now, the costs of training these AI models and keeping them running far outweigh the revenue they bring in.

As the tech industry continues to pour money into technology, how long will it take to stop the cash bleeding?

If recent reports are to be believed, OpenAI could lose $5 billion this year and run out of cash in the next 12 months without further funding — an early warning sign that smaller companies already struggling to compete with big tech companies may soon be gone.

More about AI Bubbles: Experts concerned about signs of an AI bubble