(Bloomberg) — The latest earnings reports have stoked two concerns that were already corroding the U.S. stock market: worries that the enthusiasm for artificial intelligence has gone too far and that at some point consumer spending will start to stall.

Most read articles on Bloomberg

While overall profits are still expanding at a solid pace and bank earnings continue to balloon, the concerns are holding back a stock market rally that had been driving major stock indexes to record highs until this month.

The Nasdaq 100 Index fell 2.6%, its third straight weekly decline, after Alphabet Inc.’s earnings report raised concerns about how long it will take for its investments in artificial intelligence to pay off. At the same time, earnings reports from Southwest Airlines Co., United Parcel Service Inc. and Whirlpool Corp. stoked worries about possible consumer buying slack.

The importance of this increases next week as tech industry bellwethers such as Microsoft, Meta Platforms, Amazon.com Inc. and Apple Inc. report earnings.

“Next week presents the highest hurdles ever and the strongest headwinds ever,” said Max Gokhman, senior vice president at Franklin Templeton Investment Solutions.

The sentiment is a shift from that which prevailed for much of this year, when optimism about a soft landing for the economy and investor obsession with all things artificial intelligence helped the S&P 500 hit 38 new records.

The direction of the economy is largely unchanged, with recent data pointing to solid economic growth and easing inflationary pressures. That has spurred expectations that the Federal Reserve will start cutting interest rates sooner than expected, helping rally small-cap stocks, which are typically more heavily indebted.

To be sure, there are plenty of bright spots on the earnings front: About 69% of S&P 500 companies that have already reported earnings reported earnings per share that rose from a year ago, according to data compiled by Bloomberg Intelligence as of Friday morning’s show. Bank stocks also beat sellers’ expectations, and the squeeze on industrial earnings may be nearing an end.

And companies that have reported disappointing numbers haven’t generally been punished harshly, at least so far: Companies in the S&P 500 that missed expectations on both earnings per share and sales within a day of releasing their results underperformed the broader index by an average of 1.6%, the smallest mark since 2017, according to data compiled by Bloomberg Intelligence.

Banks beat sellers’ expectations and the squeeze on industrial profits may be nearing an end.

But the scale of the stock market’s surge this year has made some investors wary, especially when it comes to big technology companies. Alphabet Inc., Microsoft Corp., Meta and Amazon.com Inc. have all invested heavily in the potential of artificial intelligence technology, leading investors to question how much profit they can make.

Google’s parent company reported better-than-expected sales and cloud revenue, while second-quarter capital spending rose to $13.2 billion, beating Wall Street expectations.

“It feels like we’re moving from ‘tell me’ to ‘show me’ when it comes to AI,” said Orson Kwon, equity and quantitative strategist at Bank of America. “Fundamentally, we’re still at a stage where we’re not seeing much evidence of monetizing AI.”

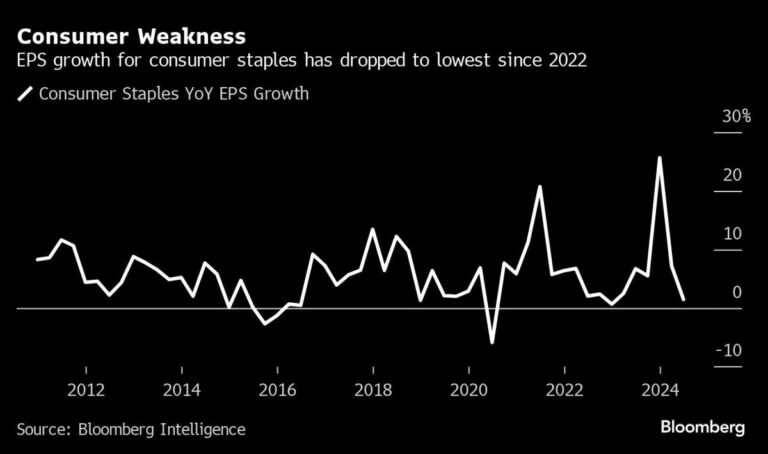

While there are still weeks until major U.S. retailers report earnings, early reports indicate that consumers, especially lower-income earners, continue to feel the pain of high interest rates and still-high inflation, with second-quarter EPS growth hitting its slowest in two years for both the consumer staples and consumer discretionary sectors.

Whirlpool Corp. cut its full-year profit outlook as a weakening housing market continues to keep consumers from buying big-ticket appliances. Shares of frozen potato supplier Lamb Weston Holdings Inc. fell their biggest ever on Wednesday after its profit and outlook fell short of analysts’ expectations.

American Airlines Group Inc. and UPS Inc. cut their profit forecasts for the current fiscal year. United Airlines Holdings Inc. beat market expectations in earnings per share, but the company said its third-quarter profit outlook would fall short of Wall Street expectations.

Matt Murray, chief market strategist at Miller, Tabak & Co., said the UPS and airline results raise “concerns about the strength of the economy.”

“And if people are shipping less, that speaks to weakness in trade,” he said.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP