Artificial intelligence (AI) chip giant Nvidia said its revenue more than doubled in the three months to the end of July compared with the same period last year, reaching a record high of $30 billion (£24.7 billion).

However, following the announcement, the company’s stock price fell by more than 6% on the New York market.

Nvidia has been one of the biggest beneficiaries of the AI boom, with its stock price soaring to more than $3 trillion.

The company’s stock price has risen more than 160% this year alone.

“It’s not just a matter of beating expectations now, the market is expecting a big underperformance and the size of the upside today seems to have caused a bit of a disappointment,” said Matt Britzman, senior equity analyst at Hargreaves Lansdown.

These sky-high expectations come as the company’s dominance in the AI chip market has seen its valuation soar nine-fold in less than two years.

Profits for the quarter jumped, with operating income up 174% from the same period last year to $18.6 billion.

This marks the seventh consecutive quarter that Nvidia has beaten analysts’ expectations for both revenue and profit.

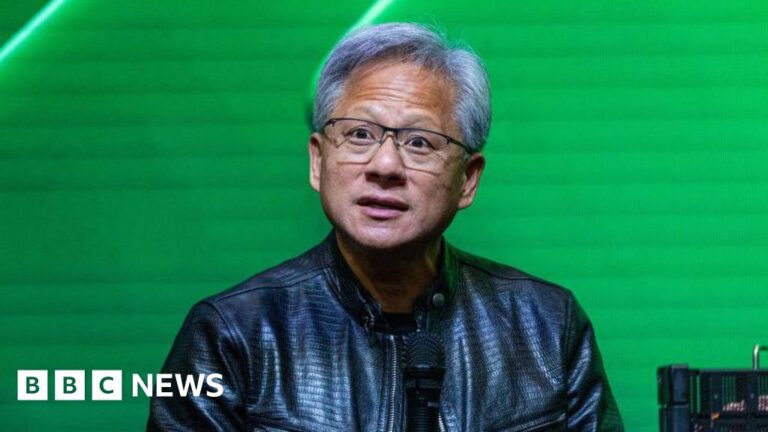

“Generative AI will revolutionize every industry,” said Nvidia CEO Jensen Huang.

The results sparked a quarterly event that sparked a stock trading frenzy on Wall Street.

According to the Wall Street Journal, a “watch party” was planned in Manhattan, where Mr. Hwang, known for his trademark leather jacket, “The Taylor Swift of tech”.

Alvin Nguyen, a senior analyst at Forrester, told the BBC that Nvidia and Huang had become the “face of AI”.

While this has been a positive for the company so far, Nguyen said it could also hurt the company’s valuation if AI doesn’t deliver after companies have invested billions of dollars in the technology.

“1,000 AI use cases aren’t enough. We need 1 million.”

Nguyen also said Nvidia’s first-mover advantage means the company has market-leading products that customers have used for decades and a “software ecosystem.”

He said rivals such as Intel could “chip away” at Nvidia’s market share if they develop better products, but that would take time.