Nvidia has been a major beneficiary of the artificial intelligence (AI) megatrend. Its chips have been in high demand, Which one is Which has allowed Nvidia to record considerable growth in revenue and profits. It has made Nvidia one of the most valuable companies in the world.

However, Nvidia is not the only company benefiting from the rise of AI. Training models and applications of AI this course Computer chips reside in data centers. These facilities are energy-hungry buildings, especially when they support AI.

As a result, demand for electricity could increase in the coming years. This should benefit energy valuesincluding the underappreciated natural gas sector. Here a few ways to capitalize on the potential boom in demand for AI-powered natural gas.

Powering the Clean Energy Transition

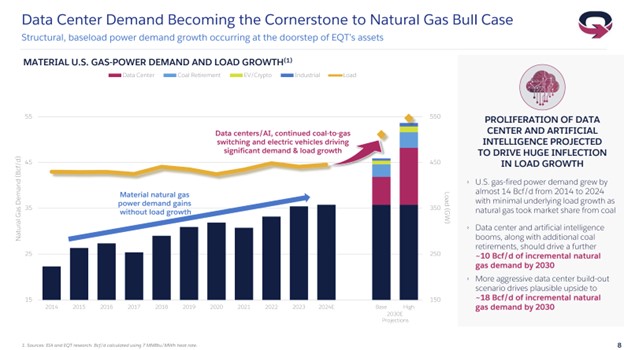

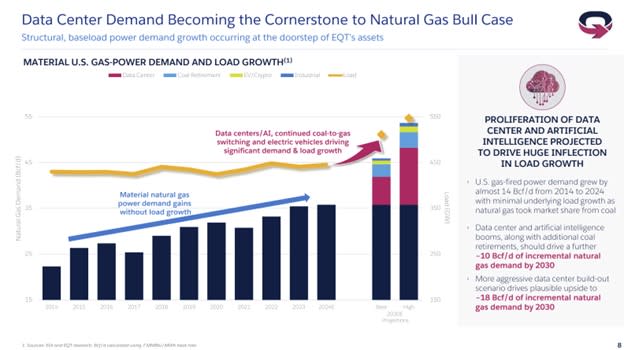

Demand for natural gas has grown steadily over the years. Several catalysts have fueled this growth, including the replacement of coal by the cleaner that burns fuel and increase LNG exports. Gas demand could accelerate in the future, fueled in part by AI data centers:

As this slide shows, data centers alone could generate an additional 10 to 18 billion cubic feet per day (bcf/d) of demand by 2030. potentially a growth greater than that experienced by the sector over the last decade.

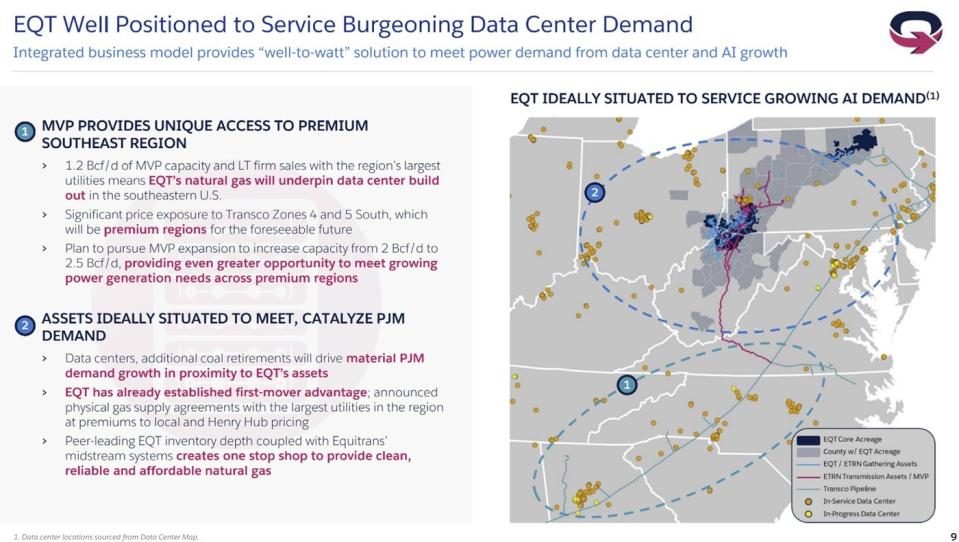

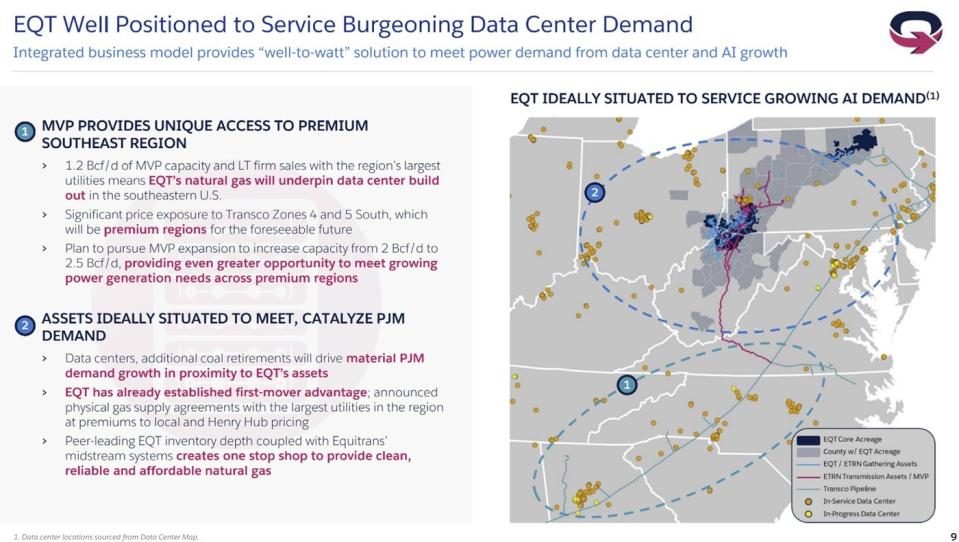

Many companies in the natural gas sector are expected to benefit from the increased demand for gas. One potential beneficiary is the country’s largest gas producer, EQT (NYSE: EQT)The company controls over 1.1 million net acres of land in the gas-rich Appalachian region (Pennsylvania, Ohio and West Virginia). This large-scale position in one of the world’s premier gas-producing regions allows it to produce gas at a very weak one cost ($1.36 per million cubic feet equivalent).

EQT is also ideally located to supply gas to data centers. The company has access to pipelines (the ones it will soon own through its Equitrans Midstream acquisition, or contracts with third-party pipeline operators) to multiple data center clusters:

EQT is expected to generate significant free cash flow in the coming years, driven by growing gas demand and other catalysts such as its ongoing agreement with Equitrans and contracts to supply new LNG export facilities. The company estimates it could generate cumulative free cash flow of $7.5 billion to over $25 billion over the 2025-2029 period, assuming gas averages between $2.75 and $5 per MMBtu.

That peak is more likely if AI lives up to its potential. That robust cash flow will give it the funds to pay down debt, pay dividends, and buy back shares, which could fuel total strong returns for investors.

Transporting gas to demand centers

Natural gas pipeline companies Passenger transportation pipelines are another major potential beneficiary of the growing demand for energy powered by AI data centers. This catalyst would increase transportation volumes on existing pipelines while providing new opportunities for expansion.

One of the many potential beneficiaries is Williams (NYSE: WMB)The company operates the Transco pipeline, which runs along the East Coast and serves high-demand areas like Atlanta, Charlotte, North Carolina and the Capital Region. Those areas are also hotbeds of data centers, which tend to be located near major cities.

In particular, Transco could play a key role in supplying gas to data centers in Virginia. Dominion Energy forecasts that electricity demand from facilities in its service area will increase two and a half times over the next decade.

Williams Currently EQT has seven projects underway to expand Transco (and three more projects on its other major natural gas transmission pipelines). It has 30 other natural gas pipeline projects under development. In addition, the company has other gas infrastructure projects underway to expand its position in the Gulf of Mexico, the Western United States and the Northeast (where EQT operates).

These projects give Williams a lot of visibility. The pipeline giant expects its earnings to grow 5% to 7% annually over the long term. That should give it the fuel to increase its high-yield dividend (recently around 4.5%) at a similar rate. This combination of dividend income, earnings growth and upside potential could position Williams to generate solid total returns in the years ahead.

AI-powered growth potential

Nvidia was an early beneficiary of the AI boom. However, the technology is expected to fuel growth in many other sectors, including natural gas. The market has yet to fully appreciate the growth potential of this cleaner fuel, which allows investors to get in early and potentially earn high returns. EQT and Williams stand out as some of the biggest beneficiaries, given their proximity to tech companies. build data centers.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat by buying the best-performing stocks? Then you’re going to want to hear this.

In rare cases, our team of expert analysts issues a “Double Down” Action Investors recommend companies that they believe are about to make their mark. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: If you invested $1,000 when we doubled our efforts in 2010, you would have $22,254!*

-

Apple: If you invested $1,000 when we doubled our efforts in 2008, you would have $41,863!*

-

Netflix: If you invested $1,000 when we doubled our investments in 2004, you would have $368,072!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” actions »

*Stock Advisor returns as of July 2, 2024

Matt DiLallo holds positions in EQT. The Motley Fool holds positions in and recommends EQT and Nvidia. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.

Beyond Nvidia: AI Could Fuel Meteoric Growth for These Underrated Stocks was originally published by The Motley Fool