Ankur Banerjee

SINGAPORE (Reuters) – Asian shares were weak on Wednesday as disappointing results from U.S. technology giants Tesla and Alphabet dampened market sentiment, while the yen hit a six-week high as interest rate hikes remain a possibility when central banks meet next week.

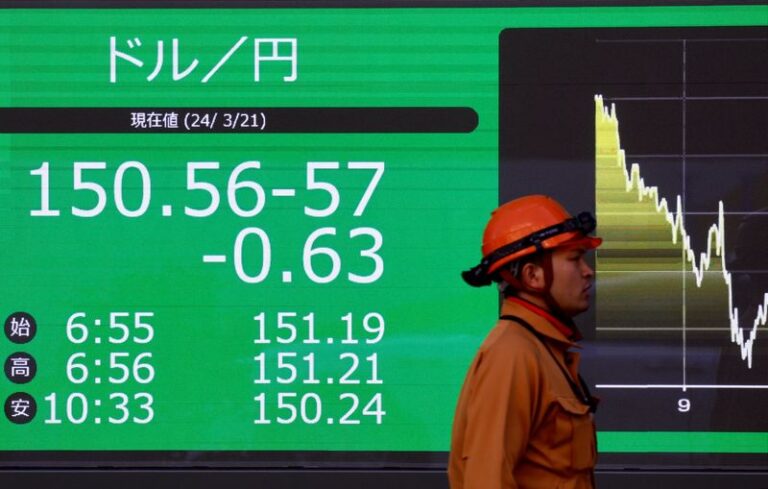

The U.S. dollar was broadly firm as traders focused on Friday’s inflation data and next week’s Federal Reserve meeting. The Bank of Japan is also scheduled to meet next week, with a 10 basis point rate hike priced in at a 44% chance. [FRX/]

MSCI’s broad index of Asia-Pacific shares ex-Japan fell 0.08% to 566.26, not far from a one-month low of 562.43 hit on Monday.

Japan’s Nikkei stock average fell 0.23 percent, while Taiwan’s financial markets were closed due to a typhoon.

Nasdaq futures fell 0.5% and S&P 500 futures fell 0.36% after Tesla reported its lowest profit margin in five years. Shares of Google parent Alphabet fell in after-hours trading even as the company beat sales and profit targets.

“Alphabet’s bar was so high that a slight earnings beat didn’t drive the stock higher, so there’s nothing to buy into in the market,” said Kyle Rodda, senior financial markets analyst at Capital.com.

“This speaks to concerns that tech stocks are too expensive here. We’ll have to wait and see how other tech giants report and how the market responds.”

Chinese stocks fell in choppy trading, with the Shanghai Composite Index down 0.18% and the blue-chip CSI 300 index losing 0.19%, its biggest one-day drop since mid-January on Tuesday.

Despite the stimulus measures, investor sentiment in the world’s second-largest economy remains fragile.

On the macro front, investors are awaiting U.S. GDP data on Thursday and PCE data (the Fed’s preferred inflation measure) on Friday to gauge interest rate cut expectations this year.

According to the CME FedWatch tool, the market is pricing in 62 basis points of easing this year and a 95% chance of a September rate cut.

Economists polled by Reuters are increasingly of the view that the Fed is likely to cut interest rates just twice this year, in September and December, as firm U.S. consumer demand despite easing inflation calls for caution.

“The U.S. consumer remains extremely resilient, but we are starting to see some underlying fragility in some of the data,” said Luke Brown, head of Asia asset allocation at Manulife Investment Management.

“We currently expect perhaps two rate cuts from the Fed, but of course there is a lot of uncertainty. We are closely monitoring the data as it develops, and while inflation has eased somewhat, underlying pressures remain.”

Circle Ride

The Japanese yen rose to 155.25 yen per dollar during Asian trading hours, having languished around a 38-year low of 161.96 yen earlier this month, before jumping nearly 1 percent on Tuesday to its highest level since June 7.

Traders suspect that the Japanese government may have intervened in currency markets in early July to pull the yen out of its lows, and Bank of Japan data estimates that authorities may have spent around 6 trillion yen ($38.62 billion) to support the fragile currency.

Repeated interventions have led speculators to unwind the popular and profitable carry trade, in which traders borrow yen at low interest rates and invest in dollar-denominated assets to earn higher returns.

The yen rose broadly, hitting its highest level in one month against the pound and the euro, and its highest level in two months against the Australian dollar.

The dollar index, which compares the U.S. currency against six major currencies, was little changed at 104.47, having fallen 1.3% this month.

Investors’ attention on Wednesday will also be focused on purchasing managers’ index numbers from around the world, a gauge of economic health.

In commodity markets, crude oil prices rose on the back of a decline in U.S. crude oil inventories. September Brent crude futures rose 0.25% to $81.21 a barrel, while September U.S. West Texas Intermediate crude oil rose 0.26% to $77.16 a barrel.

(1 dollar = 155.3600 yen)

(Reporting by Anker Banerjee and Christopher Cushing Editing)