Against the backdrop of volatile global markets, with the ASX200 set to fall following recent weakness in US trading, investors are closely monitoring movements across various sectors and indexes. Such market conditions highlight the importance of focusing on companies with high insider ownership, like Flight Centre Travel Group, especially those with strong growth potential and characteristics that often lead to alignment of interests between shareholders and management.

Top 10 growing companies with high insider ownership in Australia

|

name |

Insider Ownership |

Revenue Growth |

|

Cetile (ASX:CTT) |

28.7% |

26.7% |

|

Acrux (ASX:ACR) |

14.6% |

115.3% |

|

Clinuvell Pharmaceuticals (ASX:CUV) |

13.6% |

26.8% |

|

Catalyst Metals (ASX:CYL) |

17.1% |

77.1% |

|

Hillgrove Resources (ASX:HGO) |

10.4% |

109.4% |

|

Biome Australia Ltd (ASX:BIO) |

34.5% |

114.4% |

|

Ola Banda Mining (ASX:OBM) |

10.2% |

96.2% |

|

Liontown Resources (ASX:LTR) |

16.4% |

49.5% |

|

Plenty Group (ASX:PLT) |

12.8% |

106.4% |

|

Change Financial (ASX:CCA) |

26.6% |

76.4% |

To see the full list of 86 stocks from our “Fast growing ASX companies with high insider ownership” screener click here.

Below, we’ll highlight some of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★☆☆

overview: Flight Centre Travel Group Limited operates globally, has a market capitalisation of approximately AUD$4.98 billion and provides travel retail services to both the leisure and corporate sectors.

operation: The company derives revenue primarily from leisure and corporate travel services, with leisure revenue of A$1.28 billion and corporate revenue of A$1.06 billion.

Insider Ownership: 13.3%

Return on Equity Projection: 22% (2026 estimate)

Flight Centre Travel Group’s revenue growth is forecast to be 9.7% per year, above the Australian market average of 5.6%. While this growth rate falls short of the high-growth benchmark of 20%, the company’s revenue is expected to grow at a solid 19.1% per year, above market expectations of 13.5%. Additionally, Flight Centre has been profitable this year and is trading at a significant discount of 26.6% below its estimated fair value, highlighting its potential value for investors despite the lack of significant insider trading in recent months.

Simply Wall St Growth Rating: ★★★★☆☆

overview: PWR Holdings Limited specialises in the design, prototyping, manufacturing, testing, validation and sale of cooling products and solutions in various global markets including Australia, the US, the UK, Italy and Germany, and has a market capitalisation of AUD$1.23 billion.

operation: PWR Holdings generates revenue through two main segments, PWR C&R, which accounts for A$37.35 million, and PWR Performance Products, which accounts for A$104.44 million.

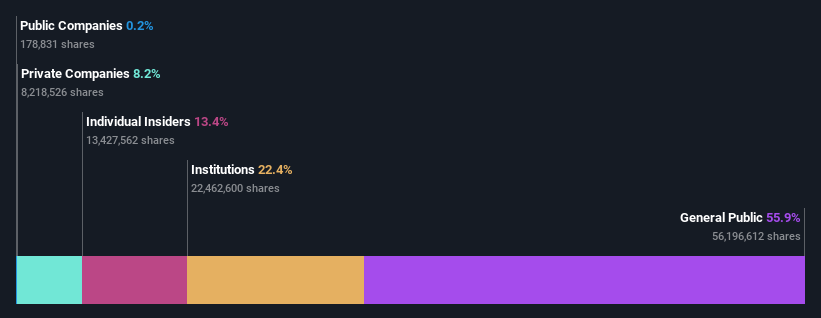

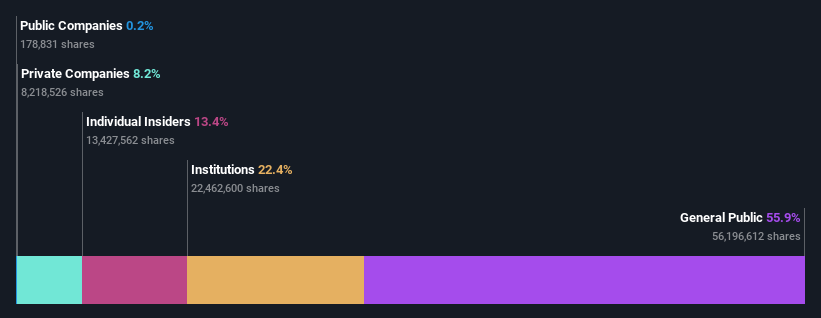

Insider Ownership: 13.4%

Return on Equity Projection: 31% (2026 estimate)

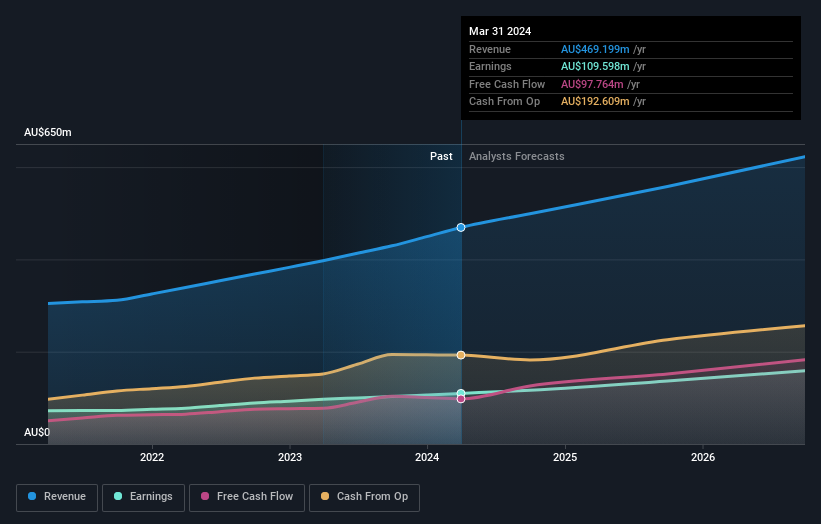

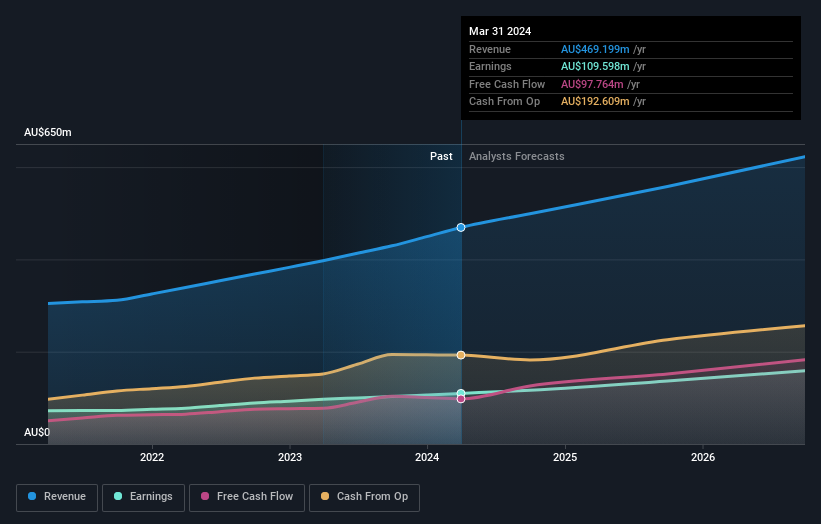

PWR Holdings is showing encouraging trends with revenue growth of 15.4% per year, outperforming the Australian market average of 13.5%. Revenue growth of 12.9% per year is solid compared to the market’s 5.6%, but falls short of the high growth benchmark of 20%. Insider buying has outweighed selling recently, but the volume has not been significant and there has been no notable insider selling in the past three months. The stock is also trading at a significant discount, trading 12.5% below estimated fair value.

Simply Wall St Growth Rating: ★★★★☆☆

overview: Technology One Limited is an enterprise software company that develops, markets, sells, implements and supports integrated business solutions within Australia and internationally, with a market capitalization of approximately AUD6.19 billion.

operation: The company generates revenue through three main channels: software sales at A$317.24 million, corporate services at A$83.83 million and consulting services at A$68.13 million.

Insider Ownership: 12.3%

Return on Equity Projection: 33% (2027 estimate)

Technology One, a growth-oriented Australian software company, has demonstrated a strong financial performance with half-year revenue of A$240.83 million and net profit increasing to A$48 million. The company’s revenue is expected to grow at 14.35% annually, slightly above the Australian market average. Its price-to-earnings ratio is high at 56.5x, but below the industry average of 60.8x, indicating relative undervaluation. Recent executive additions are aimed at strengthening the company’s strategic and operational capabilities in the global SaaS market.

make it happen

Looking for other investments?

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned. This analysis only considers shares directly held by insiders. It does not include shares indirectly owned through other means such as corporations or trust companies. All forecast revenue and profit growth rates quoted are expressed as 1-3 year annualized growth rates.

Companies featured in this article include ASX:FLT, ASX:PWH and ASX:TNE.

Have feedback about this article? Concerns about the content? Contact us directly. Or email us at editorial-team@simplywallst.com