market:

- The 10-year U.S. Treasury yield rose 5.2 basis points to 4.198%.

- WTI crude oil fell 59 cents to $82.27 per barrel

- S&P 500 down 0.8%

- Gold falls $15 to $2,442

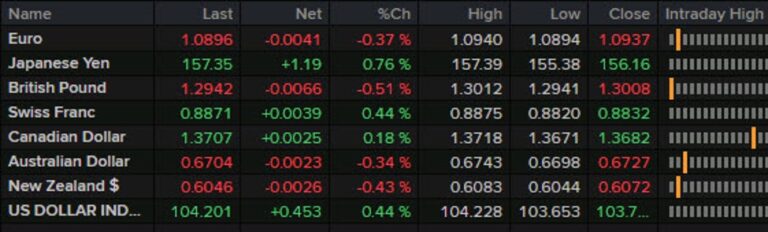

- USD Leads, JPY Lagging

Volatility remains high, including a 10% rise in the VIX today, so it’s far from a “summer market” at this point. This trend has also spilled over into currencies, with the US dollar recovering some of its losses against the yen and then rising as part of the broader US dollar movement. Yields have helped the dollar recover, in part due to the ECB warning of downside risks to growth.

In fact, the ECB decision was a bit of a disappointment, with the probability of a September rate cut remaining little changed at around 65%. The euro sold steadily, down 40 pips, but the selling accelerated in the closing session as the dollar strengthened.

The headline about jobless claims initially attracted attention and raised concerns about the U.S. job market, but a second look showed that the numbers were being boosted by the hurricanes in Texas and should reverse over the coming week.

Debate is starting to grow over the upcoming US GDP report next week, with the consensus forecast at 1.7%. With the Atlanta Fed GDP tracker hovering at a 1% point higher, risks could be on the upside for the US Dollar.

Commodity currencies also came under pressure in the closing stages as stock markets were in turmoil. Gold and oil fell on background concerns about global economic growth. China’s third plenary session announcement did not provide details on how to turn around its sluggish economy, with the official summary emphasizing a state-led, technology-centric focus. But concrete policy details are likely to emerge in the coming days.

Cable suffered its first real downturn this month after rising above 1.3000.