When it comes to the top artificial intelligence (AI) stocks to buy now, the main ones investors are watching are NVIDIAThe company has cleverly leveraged its core competencies in gaming and graphics processing units (GPUs) into the AI field, and its stock price has risen sharply as demand for AI chips has soared.

However, Nvidia’s stock price has risen to such high levels that it is now facing a significant drop in its stock price. Fortunately, the AI market is huge, and other stocks appear to have considerable growth potential. Therefore, investors looking for stocks to buy now may see higher returns by turning to long-time Nvidia partners.

Look to Nvidia’s partners instead of Nvidia

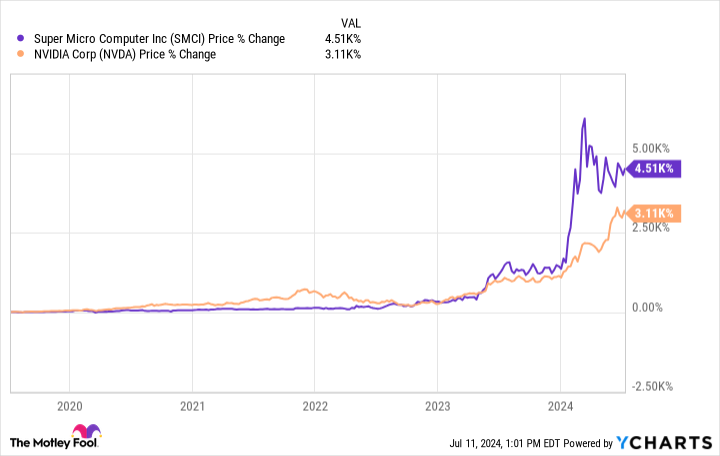

Investors, on behalf of Nvidia, Super Microcomputer (NASDAQ:SMCI)Supermicro (as it’s known) is a hardware company whose decision to build servers with NVIDIA’s AI chips has been a game changer, to say the least: The company’s stock has risen 4,500% over the past five years, a growth rate that exceeds the 3,100% gains NVIDIA has made over the same period.

This growth hasn’t come overnight. Supermicro was founded in 1993. The company is a “rack-scale total IT solutions provider” that manufactures environmentally friendly equipment for cloud, enterprise, metaverse, IoT and 5G-based solutions. Despite offering this equipment in over 100 countries, Supermicro was virtually unknown when it first began.

Still, its AI gear has propelled Supermicro to the forefront of the IT industry and accounts for most of the company’s profits to date. The company has partnered with Nvidia for several years, and its Nvidia-powered AI systems at the edge are helping to accelerate data centers, which in turn is helping to power Supermicro’s stock price.

Why buy Supermicro despite the huge profits?

Given the significant gains mentioned above, investors may think it’s too late to discover Supermicro. Admittedly, another 4,500% increase over five years is unlikely, but buying could still be profitable for investors.

Revenue for the first three quarters of fiscal 2024 (ending March 31) was $9.6 billion, up 95% compared to the same period in fiscal 2023. That led to net income for the first nine months of fiscal 2024 of $855 million, up 92%, as cost of sales slightly outpaced revenue growth.

And despite its strong revenue growth, Supermicro doesn’t expect it to slow down anytime soon. The company raised its fiscal 2024 outlook to a range of $14.7 billion to $15.1 billion. Assuming projections hold, that represents a 110% increase in annual revenue at the midpoint.

More importantly, the valuation is reasonable given the company’s massive growth: It trades for just 49 times trailing earnings, below Nvidia’s 75 times earnings.

When measured by price-to-sales (P/S) ratio, the contrast becomes even starker: Supermicro’s stock trades at just 4x sales, a fraction of Nvidia’s 40x P/S ratio. So, when it comes to stock price growth potential, Supermicro should outperform its more well-known partner over the long term.

Shop Supermicro

Despite past gains, Supermicro is increasingly looking like a stock to own. The company has already posted huge profits and seems well-positioned to continue its growth rate into the foreseeable future.

Additionally, the substantial growth over the past five years doesn’t appear to be fully reflected in the share price: With earnings growth rates in the near triple digits, a P/S of less than 50 makes it a bargain, and a price-to-sales ratio (P/S) that’s just a fraction of Nvidia’s, confirming that the stock is still relatively cheap.

Thanks to low valuations and continued growth, investors can still make big profits on now-proven growth stocks.

Should I invest $1,000 in Super Micro Computer right now?

Before buying Super Micro Computer shares, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now… Supermicro Computer wasn’t one of them. The 10 stocks selected have the potential to generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, $791,929!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of July 8, 2024

Will Healy has no position in any of the stocks mentioned. The Motley Fool owns shares in and recommends Nvidia. The Motley Fool has a disclosure policy.

“Top 10 Artificial Intelligence (AI) Stocks to Buy Now” was originally published by The Motley Fool.