It’s hard to be an AI king.

Nvidia showed that demand for AI remains high, more than doubling its revenue in the same period last year and projecting revenue of $32.5 billion in the next quarter.

But that didn’t come as a surprise to industry experts on Wednesday.

As big tech companies continue to inject billions of dollars into artificial intelligence, locking in demand for Nvidia’s prized chips, the trillion-dollar company is widely expected to post strong quarterly numbers.

What’s hurting Nvidia, however, are investors’ continued high expectations for the Silicon Valley chipmaker, especially as they grow nervous about the return on AI investments, analysts and industry experts told Business Insider.

“The numbers are very good,” Jacob Bourne, an analyst at Emarketer, told Business Insider. “The problem is that investors keep raising the bar on Nvidia every quarter, and expectations are becoming unrealistic.”

Emarketer is a subsidiary of Axel Springer, which also owns Business Insider.

Similarly, Daniel Newman, CEO of The Futurum Group, a technology research firm, told BI that Nvidia’s second-quarter numbers were strong “but that level of goodness is already priced in” by investors.

By most standards, Nvidia did more than just okay this quarter.

The company reported revenue of $30.04 billion for the quarter, more than double its revenue from the same period last year and beating analysts’ expectations of $28.86 billion.

Still, the numbers received a muted reaction on Wall Street.

What Newman described as “almost irrational exuberance” toward Nvidia was reflected in the company’s shares, which fell 6.9% after hours on Wednesday as the news was published.

According to Bloomberg, “Nvidia’s results are expected to send its shares soaring nearly 10% in either direction in the session after the report, according to options markets.”

Questions also arose over concerns about delays in shipments of the company’s Blackwell GPUs, which are expected to replace Nvidia’s Hopper, ahead of Wednesday’s earnings call.

“The recent delay in Blackwell’s market release schedule adds to investor anxiety,” Bourne told BI.

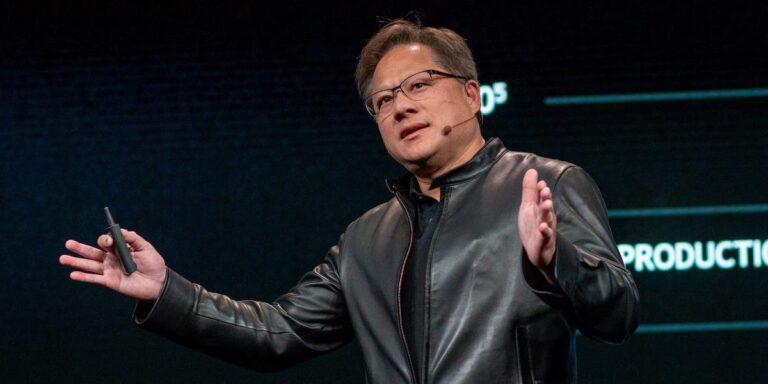

On Wednesday’s earnings call, Nvidia CEO Jensen Huang promised the company would ship billions of dollars worth of Blackwell GPUs in the fourth quarter — a metric that analysts said was vague. Nvidia executives on the call remained vague about expected profits from Blackwell even as investors followed up on the QS.

“Saying they’re going to do a couple billion dollars this year at Blackwell — that’s a pretty big range,” Grace Harmon, connectivity and technology analyst at Emarketer, told BI.

Overall, experts say Nvidia has eased most of the concerns surrounding Blackwell’s shipping delays, but it will be critical for the company to deliver.

“We believe it will be more difficult for the company to beat expectations by a wide margin; however, the company will receive a boost with the launch of the new Blackwell chip later this year,” wrote Logan Purk, technology analyst at Edward Jones.

While high expectations may be working against Nvidia, Huang is still setting high standards for the company’s future.

“Next year is going to be a great year. We expect to grow our data center business significantly,” Huang said on the call. “Next year, Blackwell is going to be a complete game changer for the industry, and Blackwell is going to continue to do that in the following year.”

Emma Cosgrove contributed to this report.