[Adobe Stock]

Apple, Dell, Intel… The news of tech job cuts keeps hitting the headlines. But don’t think Silicon Valley is the only one struggling: A closer look reveals a surge in job cuts across multiple R&D-intensive industries.

Tesla is cutting 14,000 employees (10% of its workforce) in April 2024. Other transportation companies making cuts include electric vehicle (EV) makers Fisker, Lucid Motors and Rivian, and electric bike maker Rad Power Bikes.

But the tech industry hasn’t seen such massive, sustained layoffs since the dot-com bubble burst.

In R&D intensive areas, hardware and infrastructure reductions have been made.

In the hardware division, Dell is reportedly cutting around 12,500 employees as part of a restructuring. The move dovetails with the company’s focus on AI through the new group, according to a Channel Futures report. Other hardware-related cuts include Intel planning to cut around 15,000 jobs. Meanwhile, GoPro has announced plans to lay off 15% of its staff, and Sonos has cut 6%. Companies making cuts include infrastructure company Fastly (11% of employees), edge computing and security company Stackpath (closing permanently), internet governance body ICANN (33 employees, 7% of employees) and cloud delivery platform Pax8 (cutting 5% of employees).

In the healthcare space, Ginkgo Bioworks, a biotech company that raised $1.6 billion through a SPAC in 2021, cut its workforce by 35%, laying off 400 people. Care/of, a personalized healthcare provider, closed permanently, losing 143 jobs. And Cue Health, known for its at-home COVID-19 testing kits, cut 230 employees (49% of its workforce) and closed its manufacturing facility in May.

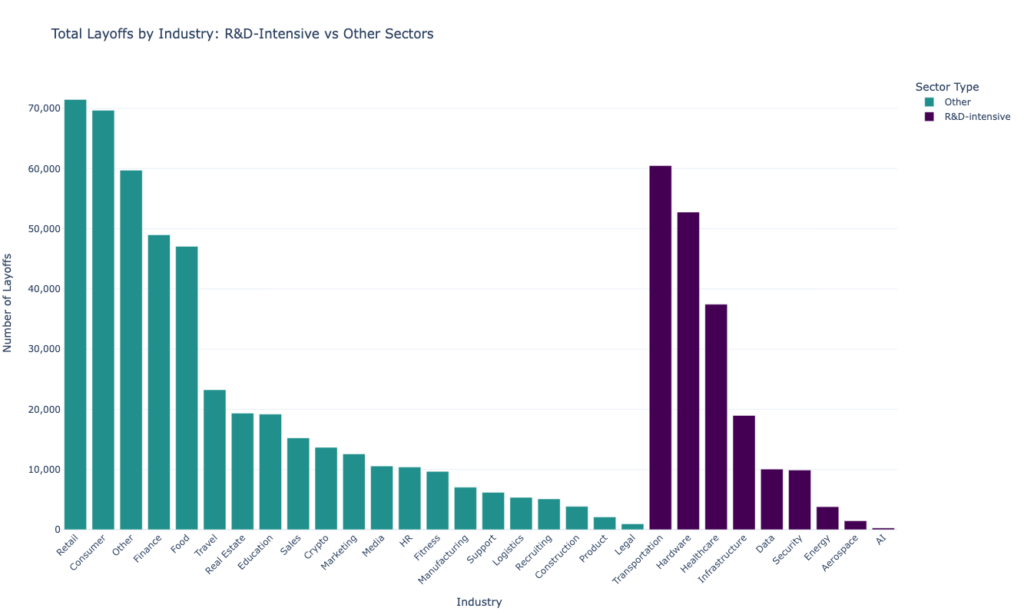

The pain won’t be felt equally across all departments: This chart shows which R&D-heavy divisions are feeling the pressure from the layoffs the most.

Layoffs in R&D-intensive sectors compared to other sectors [Data from Kaggle]

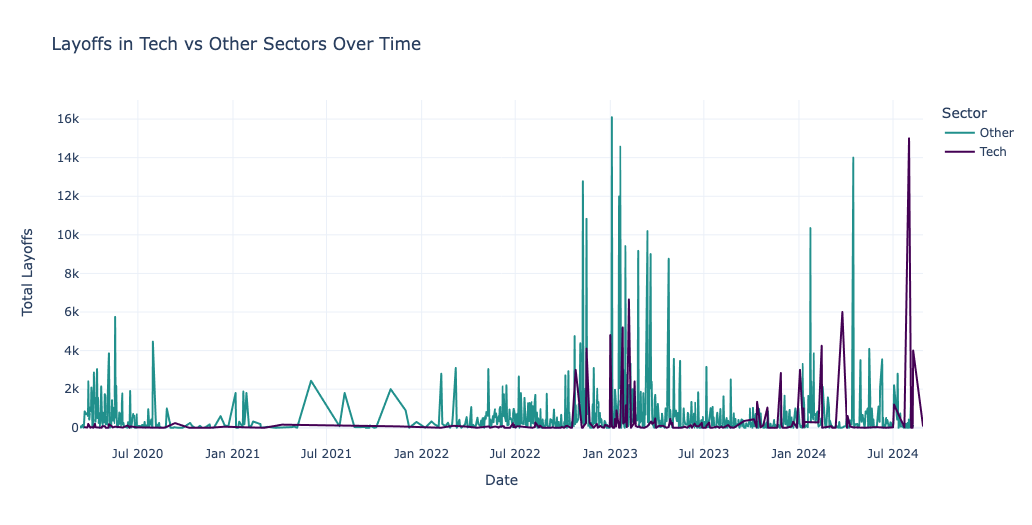

Pace of tech layoffs remains roughly steady, but not in August

Layoffs have been a recurring theme across the technology industry, though they have tapered off compared to 2023 totals. However, August 2024 was a tough month with Intel, Dell, Cisco, and Apple all cutting jobs. According to data from the Bureau of Labor Statistics, the pace of job cuts in the information technology sector, a metric for the technology industry, has not slackened as much as other sources have suggested. Information technology job cuts increased slightly from 0.90% in June 2023 to 1.00% in June 2024 (provisional), a change of 0.10 percentage points.

As tech companies make targeted cuts focused on certain sectors and projects, many are touting their investments in AI and automation-related projects. Some companies have begun rehiring in strategic areas while cutting back in others. This is reflected in data from the Bureau of Labor Statistics, which shows that R&D-intensive industries such as manufacturing, IT, and transportation have a higher average layoff rate in June 2024 (1.17%) than non-R&D-intensive industries (0.86%), based on preliminary data.

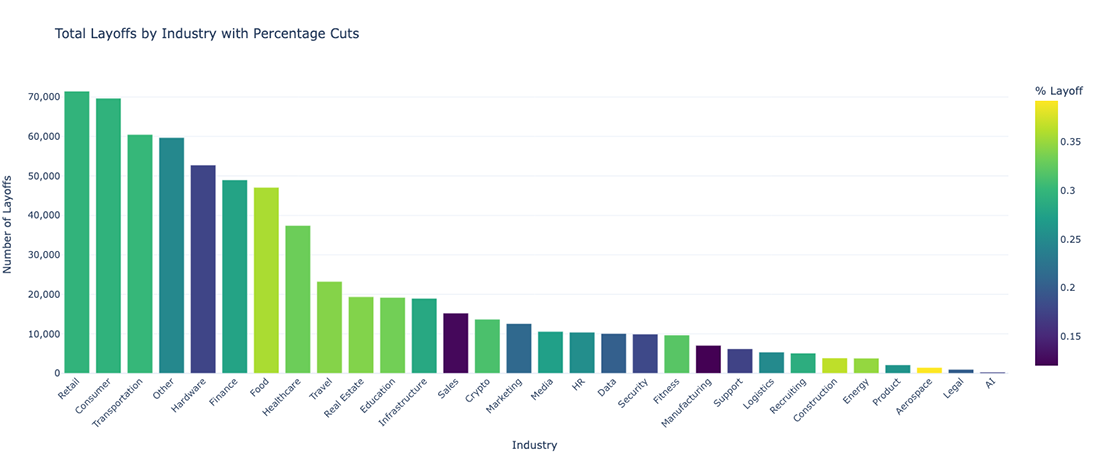

Retail, consumer and transport sectors hit hardest

Technology-related sectors such as data and security have remained in the moderate to low range for layoffs. Cybersecurity, in particular, has long faced a shortage of skilled workers, which may have led to relatively low layoffs. This trend may indicate continued demand for specialized skills in these fields despite industry-wide cuts.

Number of layoffs by termination rate (percentage data not available for all categories) [Data from Kaggle]

Experts debate whether AI will destroy or create jobs, but either way, the technology is likely to be disruptive for many. The World Economic Forum predicts that AI will destroy 85 million jobs and create 97 million new jobs by 2025, with job losses and gains unevenly distributed across sectors. The WEF notes that roles involving routine, manual tasks are most vulnerable to automation, while jobs in technology, data science, and AI-driven fields are likely to see increased demand. While the outlook for STEM fields is generally bright, industries that rely heavily on routine, manual tasks, such as natural resources and chemicals, are more likely to be automated, with 64% and 56% of tasks in these sectors, respectively, likely to be automated.

Conversely, industries such as Software & Platforms and Communications & Media have a significant percentage of employees working in tasks that are more likely to be augmented than fully automated. In Software & Platforms, for example, 28% of tasks have been identified as having the potential for augmentation.

The WEF notes that life sciences and high tech have mixed prospects, as 50% of tasks in these industries are classified as non-verbal and generally less amenable to automation. However, a significant amount of work (17% in life sciences and 16% in high tech) could be augmented by AI, particularly in roles related to data analysis, research and development.