In a rare interview about his investment career, private equity tycoon Jahm Najafi reveals what he looks for in companies, how he capitalizes on bursting market bubbles, and why he’s bullish on Ukraine.

By John Hyatt, Forbes Staff

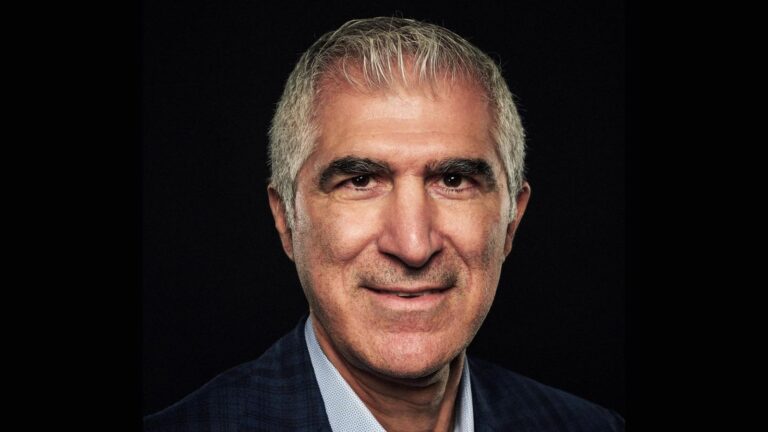

Jahm Najafi, 61, is a Phoenix-based private equity investor and philanthropist. An Iranian by birth, Najfi immigrated to the U.S. with his older brother Francis in 1975 when he was 12 years old. He received his B.A. in political science and economics from the University of California Berkeley, followed by his M.A. in business economics from Harvard University in 1986. He began his career on Wall Street working for Salomon Brothers before teaming up with his older brother in 1990 to help run the Pivotal Group, a real estate investment firm.

Najafi struck out on his own in 2002, launching the Najafi Companies, a buyout firm to manage his own capital. His most lucrative investment was a $100 million bet in 2003 on domain registrar Network Solutions, which he sold for $800 million just four years later. In 2009, Najafi purchased a 10% stake in the Phoenix Suns for an estimated $43 million; that stake is now worth $400 million.

Over the years, Najafi has invested across a range of industries, including entertainment, consumer goods and other sports franchises, including the McLaren Formula 1 team. Worth an estimated $1.4 billion, Najafi last year signed the Giving Pledge, a promise to give away at least half of your fortune during your lifetime or after you die.

Forbes: Looking at today’s macro environment: What are some of the biggest risks that investors are facing right now?

Najafi: They are geopolitical risks: U.S.-China relations, Ukraine, Israel. This is probably the most uncertain environment since World War II that we operate in from a geopolitical standpoint, but also from a domestic political standpoint, both in Europe as well as the U.S. Are we on the verge of significant changes to liberal market principles and democracy? What’s really helped our global economy grow significantly since World War II are liberalization and trade, which have allowed many people around the world to come out of poverty who also, frankly, are great consumers for American products. America is considered the beacon from a technology and product standpoint, and many people around the world can afford to buy our products because of the fact that they have gotten wealthier. It’s been a wonderful spiral up. So liberalization and trade policies are particularly a concern.

Forbes: What about opportunities: Is there a particular investment idea or investment theme that you think is particularly salient for investors today?

Najafi: I continue to believe in finding particular geographic areas or industries that are going through challenging times, and identifying products and services that cannot be necessarily replaced by technology or artificial intelligence. We don’t invest in new ideas because we don’t have the understanding or the expertise. We don’t invest in AI and we never invested in crypto. We don’t invest in things that I can’t simply explain to others.

From a geographic standpoint, if I were willing to take certain risks, I would consider Ukraine to be a very fascinating place. It will have to be rebuilt. There will be trillions of dollars of capital that will go into it post war. It’s a resilient nation and resilient people. They’re not going to be defeated. It’s a fascinating location to think about from an infrastructure standpoint, but also from a real estate and human capital standpoint. In technology, they’re among the best in the world.

Domestically, I do not think that real estate and offices are going away. What’s happening is we’re spending a lot of time on Zoom, we’re not interacting as much socially as we used to, and as a result the experiential side of the economy is taking off. People are willing to pay a premium for specialized events and those types of experiences. Currently, we’re focused on sports with multi-day events like X Games, which we invested in in 2022.

Forbes: How did you get your start in investing?

Jahm Najafi: My investment career started in 1990 when I left Salomon and I came back home to Phoenix. I started looking at real estate investment opportunities shortly after the federal government created the Resolution Trust Corporation to take over a number of savings and loans institutions that had gone bankrupt in the latter part of the 1980s. I joined my older brother Francis in forming a little investment group. He was the majority partner, and I was a minority partner. We thought it was the right time for us to start looking at RTC assets, because the underlying economics of real estate were still positive. Between 1990 and 1993, we would tie up properties, then look for capital to acquire them. In 1993, we were able to attract three pension funds to our effort. We significantly grew that business until 2002, when I left. I decided to create my own investment firm, the Najafi Companies, because I wanted to think about investments on a much longer time horizon than what’s typical of a private equity fund. I decided not to raise any third party capital and only invest my own, internally generated capital.

Forbes: What were some of your first investments as a standalone investor?

Najafi: The very first investment I made was a fairly small one in a nutritional supplement company. We ended up selling that a couple of years later, making twice that money back. The second investment we looked at was a subsea cable in the Pacific. It was built in the 1990s for about $850 million and had filed bankruptcy. We were looking at buying it for about 10 cents on the dollar; we had it tied up for about $66 million, but because of the regulatory requirements and approval processes in different local and national jurisdictions, it was going to take six months. And during that six month period, the value had gone up significantly, and the bankruptcy estate decided not to sell it to us at the lower price. So we got a break fee, which was 10% of our purchase price.

Forbes: One of your earliest investments–a dot-com business called Network Solutions–turned into one of your biggest successes. How did you identify that opportunity, and then how did you execute on it?

Najafi: One of the reasons I decided to invest in telecom and internet services was that I saw similar dynamics as I had seen in real estate in the 1980s. You had the deregulatory Telecommunications Act of 1996, and there was a significant inflow of capital that led to a huge market increase. It overwhelmed demand and by 2000 and 2001, prices started crashing and a number of these telecom and internet services companies were going under. I thought we should really focus on this industry because there were significant, undervalued assets. It’s a theme that you will see throughout my investment career, which is always looking at new and unique opportunities that require very unusual pricing valuation parameters.

The way we came across Network Solutions, which we acquired in October 2003, was that in the latter part of 2002 there were more than 100 different companies that were being traded publicly at less than the amount of cash they had in the balance sheet. I decided to focus on one business that I could easily understand, and that business was Register.com, a domain name registrar that was publicly traded. It had about $240 million cash on the balance sheet, but it had about 44 million shares trading at $2 a share. It was somewhat misunderstood because there was deferred revenue: For every customer who bought a domain name, the company would not recognize it for another 12 months because it was an annual payment. I had done some research and there was a fast growing local company called GoDaddy in Scottsdale, so I called its founder Bob Parsons and said, ‘Hey, Bob, I’m really fascinated with your industry and your business, let’s partner up,’ and he said, ‘That’s a great idea, let’s do it.’

But unfortunately, another company ended up acquiring Register.com. About three weeks later, Bob called me back up and said, ‘I just heard from VeriSign. They want to sell Network Solutions. Are you interested?’ At the time Network Solutions was considered the whale in the industry. It was the largest domain name registrar. Bob ultimately couldn’t move forward as a partner on that deal as a competitor, so I went ahead on my own and was able to close in November 2003 for $100 million. Our philosophy was that if anybody is buying domain names, they also need the website, and they need to be found on the web, and they need to be hosted, and they need e-commerce services. All that is common sense now, but in 2003 it was not a given. In the following three years, we either acquired or built all these other services and turned what was a $35-per-year domain name business into monthly recurring revenues. The management team executed flawlessly: We tripled Ebitda and doubled revenue, and we got an incoming offer in 2007. We decided to talk to a couple of parties and eventually, we ended up selling that business for $800 million.

Forbes: You’ve invested across different types of industries. What is your approach to identifying opportunities in sectors that you’re less familiar with?

Najafi: The most important job we have is partnering with the right management team. I could study an industry for years, and I’d still be nowhere near the management team’s level of expertise. Our approach to any investment is finding the right team, then asking them the right questions, thinking about strategic considerations and staying out of their way, letting them do their job. My philosophy is that the board of directors should never direct—it’s a misnomer. The board should be there and know when to challenge assumptions and present some ideas, but at the end of the day, it’s always the management team that makes the final decision.

Our value-add to this process is our knowledge of the general market economy, our knowledge of valuation and pricing, [and] our ability to think about businesses differently. For example, with Network Solutions the management team thought of itself as being a domain name registrar. We said, No, we are an online services provider.’ That change in approach immediately clarifies what we do and what industry we are in. Trend Homes thought of itself as in the homebuilding business. We said, ‘No, you are in the home-making industry.’ Meaning, you need to hold customers’ hands from the very beginning all the way to the end, even after they move in.

My view is that a satisfied customer is always the least expensive form of marketing. You have to ensure that every customer is satisfied, and that the product we’re providing for them is truly value additive to their life. That’s why we don’t invest in certain industries. I don’t invest in any business that I can’t tell my kids about with a straight face. We won’t invest in payday loan businesses. We won’t invest in gaming or gambling enterprises. We won’t invest in a number of different businesses, no matter how much money you can make.

Forbes: We’ve talked about success, now let’s look at failure. What investment was one of your biggest disappointments, and what did you learn from it?

Najafi: One of the industries that we thought we could change is in the content development business. There are a number of agencies and management companies that put together that packaged content. These firms historically thought of themselves as a fee driven business. They bring together producers, actors, screenwriters, and other parties, and charge a certain percentage. We thought of that business as being an essential depot of information. So we said, let’s use all that knowledge to be able to have a sidecar and invest, and effectively create a one-stop-shop, for all of that content to be made internally in the context of the agency or the management company. So that was the thesis behind Resolution, which launched in 2013. We went after it extensively for two or three years. We made a significant investment in that business and created a sidecar to provide investment for the content. But unfortunately our thesis did not come to fruition. It was still too early for that idea and the business failed. I violated my first rule: There was no significant dislocation in that industry. And clearly execution is key. We did not execute very well and we realized that it’s very difficult to change the thought process of people in an entire industry.

Forbes: Tell us more about your investment philosophy of identifying unusual pricing parameters. What do you mean by that?

Najafi: I would say it’s more about identifying economic or industry-specific dislocation. It happened first in the early 1990s in the real estate markets, which really created the knowledge and the discipline to think of businesses as an investment over a 5-to-10-year period. You have to think about both downside risk and upside opportunity; markets turn around, as long as the underlying business is fundamental. The use of buildings never went away during the 1990s real estate crash. Demand for telecom and internet services did not go away during the crash of the 2000s. You had a huge oversupply of capital into those industries overwhelming demand, leading to prices crashing.

The same thing happened in 2008 and 2009 during the housing crash. So in 2009, we decided to go and buy a home builder, Trend Homes. When you have those kinds of systemic crashes, what you do is you go buying businesses that are still fundamentally sound. You can buy effectively based on lower Ebitda numbers, but also lower multiple numbers because there’s not as much demand from an investment standpoint. So during recovery, not only does the Ebitda and underlying economic business continue to improve, but multiples also go up significantly. Effectively what you have is a double up. In 2012, a national home builder made us an offer for Trend Homes that we couldn’t refuse, so we exited that investment.

Forbes: If you could give your 20-year-old self some advice about investing, what would it be?

Najafi: Make very few definitive decisions. Allow yourself to make a lot of small mistakes that are not fatal, and learn from them. When you come to a fork, take it. Know that you have the capabilities to think about things critically on a day in, day out basis. Pivot as you learn more and more, because life is a lesson in learning and gaining experience over time. The more learning experiences you allow yourself to have, the more successful you end up being later in life.

Forbes: Do you have any book recommendations that you recommend investors read?

Najafi: One thing that I value is being real and authentic to myself, which is why I really enjoyed William Green’s Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life. It was a fabulous book because it really had to do with being authentic—about being real and true and leading a fulfilling life.

The other book I read at the beginning of my career was Peter Lynch’s One Up On Wall Street. It stuck with me because one of his pieces of advice was, ‘I give myself 10 decisions a year.’ So now if I make a decision to buy or sell something, I always cross one decision off my own list of 10. So the decisions I make better be damn good decisions.

Forbes: Thank you.

MORE FROM FORBES