Speaking on “Making Money,” Beth Kindig, chief technology analyst at I/O Fund, explains what’s causing Nvidia’s recent stock price decline.

Artificial intelligence giant Nvidia The company reported its latest second-quarter results on Wednesday, which beat analyst expectations thanks to the company’s continued AI-driven momentum.

Wall Street According to LSEG data, NVIDIA is expected to report earnings per share of $0.64, up 137.5% year over year, on revenue of $28.7 billion, up 112.5% year over year. Earnings per share were $0.68 on revenue of $30.04 billion.

Revenue from data center, Nvidia’s largest business segment, was expected to rise 144% from last year to $25.15 billion. The company beat expectations in the segment, bringing in sales of $26.27 billion, up 16% from the previous quarter and 154% year over year.

“Demand for Hopper remains strong and our expectations for Blackwell are incredibly high,” Nvidia founder and CEO Jensen Huang said of the company’s core chip products and next-generation products.

AI giant NVIDIA faces antitrust investigation call from innovation group

Nvidia’s second-quarter profit beat Wall Street expectations. (Lauren Elliott/Bloomberg via Getty Images/Getty Images)

“NVIDIA delivers record revenue as data centers around the world work to modernize their entire computing stack. Accelerated Computing and Generative AI” Huang added.

| Ticker | safety | last | change | change % |

|---|---|---|---|---|

| NVDA | NVIDIA Inc. | 125.61 | -2.69 |

-2.10% |

Analysts have expressed concern about delays in Blackwell’s AI chip production, which could result in delayed deliveries and impact revenue in the coming quarters. Huang said in a company statement that Blackwell has started shipping samples, but did not provide a timeline for when it plans to ramp up production beyond 2025.

How NVIDIA went from Denny’s to $2.3 trillion chipmaker mogul

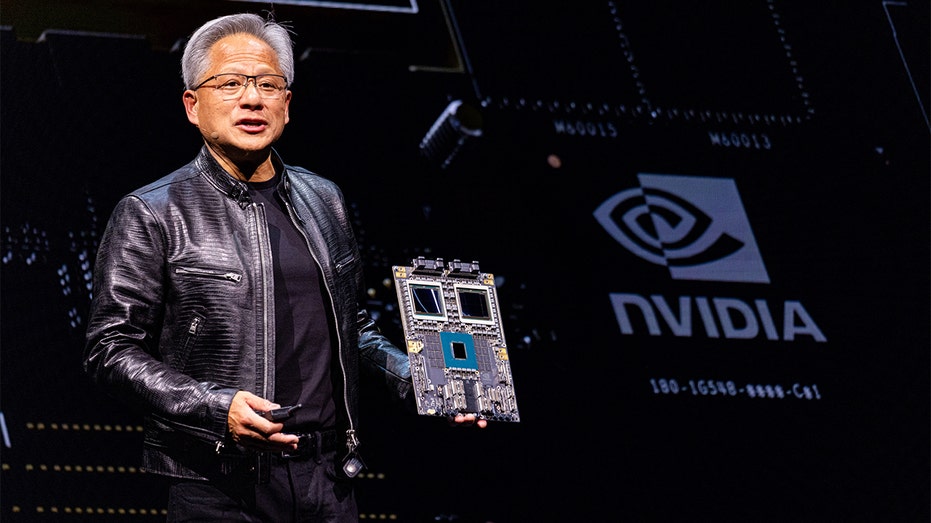

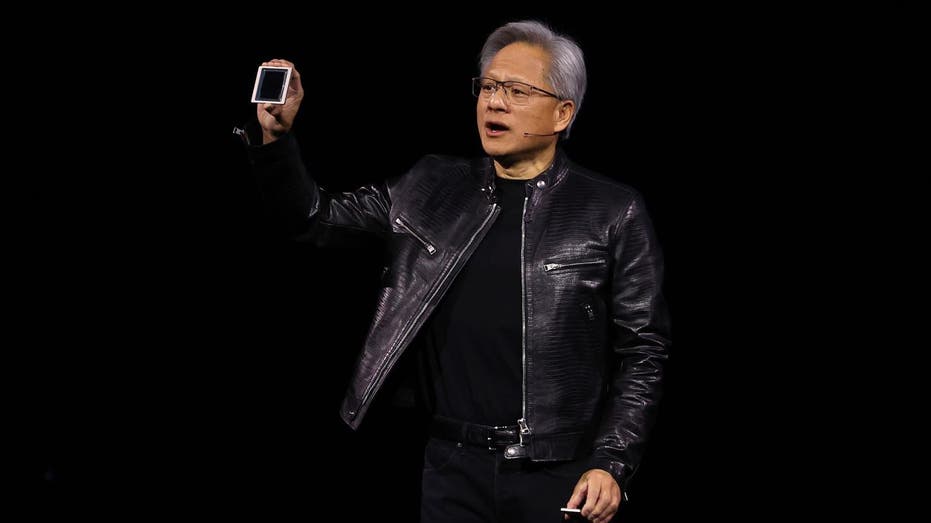

Nvidia founder and CEO Jensen Huang said demand for the company’s Hopper chips remains strong as expectations for the company’s Blackwell chip grow. (Annabel Chee/Bloomberg via Getty Images/Getty Images)

“Blackwell samples are shipping to partners and customers. Spectrum-X Ethernet for AI and Nvidia AI Enterprise software are two new product categories that have achieved significant scale, demonstrating Nvidia’s full-stack, datacenter-scale platform,” Huang said.

“Across the stack and ecosystem, we’re helping cutting edge model makers to consumer internet services and now enterprises. Generative AI will revolutionize every industry.”

What is Artificial Intelligence (AI)?

NVIDIA CEO Jensen Huang unveiled the Blackwell AI chip during a keynote address at the NVIDIA GTC artificial intelligence conference, held March 18 at the SAP Center in San Jose, California. (Justin Sullivan/Getty Images/Getty Images)

Options markets had expected Nvidia’s shares to rise or fall 9.8% on Thursday following the results, a move worth more than $300 billion given the company’s market capitalization of about $3.11 trillion.

Nvidia shares closed down 2.1% during Wednesday’s trading session, meaning the semiconductor giant’s shares have risen more than 160% so far in 2024. The closing price of $125.61 was 7.4% below its all-time high set on June 18.

in After-hours tradingNvidia’s shares fell to a low of $116.29 ahead of the earnings announcement, but then pared the decline and traded around $120.

Click here to get FOX Business on the go

Nvidia also issued a third-quarter revenue outlook that beat Wall Street expectations. Revenue Forecast Third-quarter sales were $32.5 billion, plus or minus 2%, beating analysts’ average estimate of $31.77 billion, according to LSEG data.

Reuters contributed to this report.