A fresh week and a fresh start for Nvidia stock. After a few down days for the chipmaker, the stock rose on Monday on media reports that the company will make a new AI processor for the Chinese market.

The development serves as a reminder of Nvidia’s capacity for innovation but also its political challenges.

In mid-morning trading, shares were up 3.4% at $121.99. Investors are buying Big Tech stocks again after last week’s decline. Shares closed down 2.6% on Friday.

Two other possible reasons for the rally: the new chip report and a new, higher price target from Piper Sandler analyst Harsh Kumar.

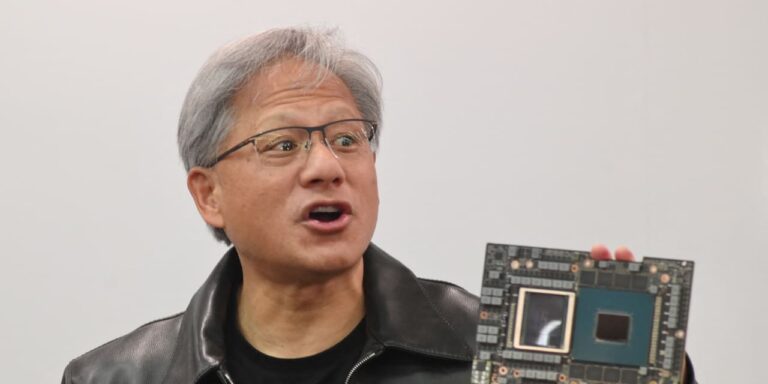

Nvidia plans to make artificial intelligence chips for the Chinese market that will be compliant with U.S. export controls, Reuters reported, citing people familiar with the matter. The company will work with Inspur, one of its distribution partners in China, on the chips, called B20, the report said.

Advertisement – Scroll to Continue

Nvidia did not immediately respond to a request for comment.

The U.S. government announced export restrictions in 2022 in an effort to prevent China from developing its AI technology. In October, the Commerce Department extended the restrictions and imposed licensing requirements on Nvidia for certain chips used in data centers.

New chips for the Chinese market could be a positive, but it’s unclear whether Nvidia will be able to stay ahead of the competition and comply with US restrictions.

Advertisement – Scroll to Continue

Any more powerful chip would increase the likelihood of tougher US sanctions, but a less capable processor would be more vulnerable to competition from domestic companies like Huawei.

China accounted for 14% of Nvidia’s total data center revenue in fiscal 2024, which ended in January—down from 19% a year earlier. The company has repeatedly said it expects strong demand in other regions to fully offset the projected impact on China sales from U.S. restrictions.

Two other chipmakers, Advanced Micro Devices and Intel

Indonesian:

increased—by 2.4% and 0.4%, respectively. AMD and Intel both have chips designed specifically for the Chinese market.

Advertisement – Scroll to Continue

In a research note, Piper Sandler’s Kumar raised his price target to $140 from $120 and maintained his Overweight rating.

The new price target is based on a price-to-earnings multiple of 41 times Kumar’s estimate for Nvidia’s fiscal 2026 revenue.

“We see the strong business trends Nvidia demonstrated last year continuing with the help of the official launch of the Blackwell architecture in the October quarter,” Kumar wrote.

The stock is up 138% this year through Friday’s close. That compares with a 15% gain in

S&P 500 Index

index and an increase of 18% in

Nasdaq Composite Index.

Write to Adam Clark at adam.clark@barrons.com