The company is reaping huge profits from the AI boom, with tech giants pouring billions of dollars into Nvidia chips to power large-scale language models like ChatGPT and Gemini, but questions remain about whether these companies are actually making money from AI and whether they can maintain their frenetic pace of spending.

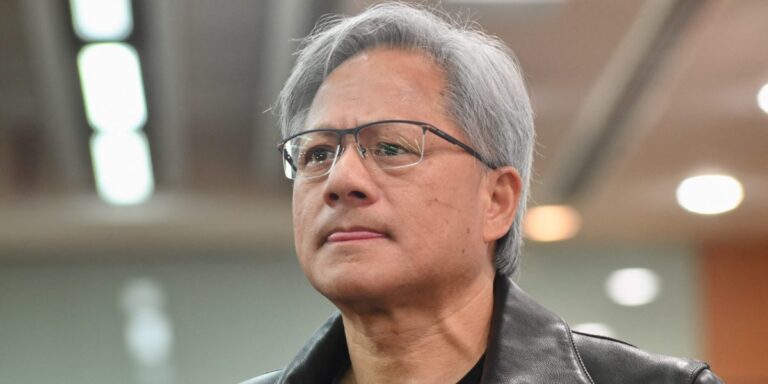

Asked about the sustainability of customer spending during the company’s earnings call on Wednesday, Huang didn’t answer the question, even as he extolled AI’s ability to transform computing.

Huang spoke for eight minutes about how regular CPUs, the standard around the world, are reaching peak capacity, the wonders of accelerated computing powered by Nvidia’s flagship GPU, and how even independent nations are getting into AI.

“There are so many different directions that generative AI can go, and we’re really seeing momentum for generative AI accelerating,” he said.

An Nvidia spokesman declined to comment. luck.

The AI tools that already exist (such as ChatGPT, AI image generators and coding assistants) are just the tip of the iceberg: beneath the surface lie future mainstream applications such as hyper-targeted advertising, recommendation systems that predict future wants and needs, and improved search engines, he added.

But analysts were not satisfied with Huang’s answer, and the topic of customer spending came up again. This time, Huang did not mince words.

“Those who are investing in Nvidia infrastructure are seeing immediate benefits. This is the highest ROI infrastructure, computing infrastructure investment you can make today,” he said.

Huang questioned why Nvidia’s data center customers, which account for about $26 billion of the company’s $30 billion revenue, have already spent $1 trillion on general-purpose computing infrastructure that, in Nvidia’s view, is a thing of the past, so want to build more infrastructure.

“If you build a commodity CPU-based infrastructure, for every $1 billion you’ll pay less than $1 billion in rentals because it’s commoditized,” he said.

Meanwhile, data centers built with Nvidia’s chips for fast computing will save costs and see increased demand from a growing number of startups creating the “next frontier” in AI, Huang reasoned.

“The world of general-purpose computing is moving to accelerated computing. The world of human-designed software is moving to generative AI software,” Huang said. “If you’re building infrastructure to modernize your cloud and data center, build it with Nvidia for accelerated computing. That’s the best way to do it.”

As of Wednesday, NVIDIA was the second-most valuable company in the world, with a market capitalization of $3.09 trillion, behind only Apple. The company reported revenue of $30 billion, double its revenue from the same period a year ago. The company’s profit of $16.6 billion was also more than double what it earned in the same period a year ago, and the company said it expects revenue of $32.5 billion for the current quarter, above analysts’ expectations of $31.9 billion.

Despite Hwang’s optimistic comments, Nvidia shares fell nearly 6% in after-hours trading on Wednesday.

The new special issue features a Wall Street legend getting a dramatic makeover, tales of cryptocurrency shenanigans and badly behaved poultry royalty, and more.

Read the story.