Key Takeaways

- According to a recent report from Deutsche Bank, the recent decline in tech stocks has coincided with a rise in utilities, healthcare and consumer staples stocks, an echo of the dot-com bubble of 2000.

- Uncertainty surrounding the U.S. election and monetary policy could continue to weigh on tech stocks in the coming months, according to one analyst.

- Despite the dot-com bubble bursting, technology investments have significantly outperformed the overall market over the long term.

A recent report from Deutsche Bank draws parallels between the current Big Tech exodus and the collapse of the tech bubble in 2000, giving reason to believe history is repeating itself.

In the nine months after the bubble peaked in March 2000, tech stocks fell by more than 50%, while the consumer staples, utilities, and health care sectors each rose by more than 35%.

Deutsche Bank

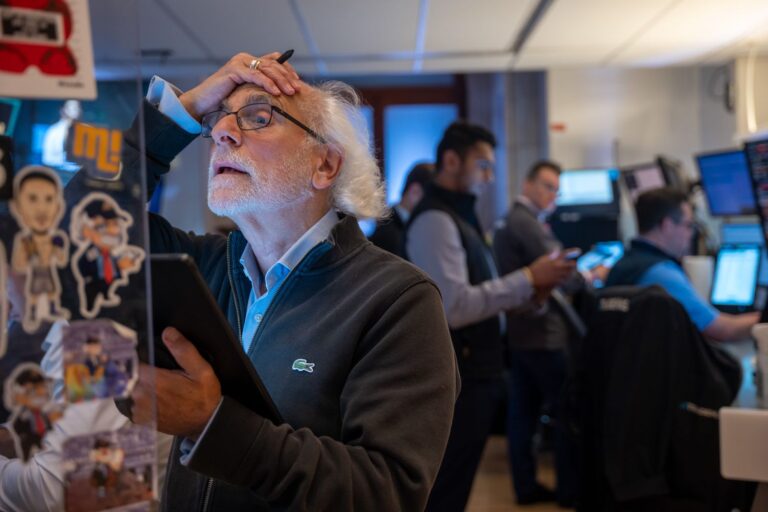

Research analyst Jim Reed sees parallels between that moment and the current sector rotation among big tech stocks. The Magnificent Seven fell about 12% between July 10 and Thursday but are recovering some of their losses in today’s trading. The S&P 500 is down about 4% in the same period. But seven of the 10 sectors in the index have risen over that period, just as they did in 2000, led by utilities and health care.

“The bottom line is that if technology stocks continue to correct, other sectors should see modest gains, especially since technology stocks’ size dwarfs other sectors,” Reid wrote. “So even small exoduses from technology could mean large inflows into other sectors.”

Uncertainty weighs on tech industry in the short term

The recent sell-off in high-flying tech stocks naturally raises the question: should you buy low? The answer depends on your timeline.

“The tech market is likely to remain volatile at least through the election,” said Angelo Gino, a tech analyst at CFRA, given the uncertainty created by the looming election and the prospect of interest rate cuts later this year. [tech] In relative terms, it has become more limited and less popular.”

Here the dot-com bubble offers another lesson: Technology and communications stocks continued to fall after 2000, losing roughly 85% and 75% of their value, respectively, by the end of the post-bubble bear market in late 2002. An investment in the tech-heavy Nasdaq Composite Index in early 2001 would have underperformed the S&P 500 until 2009. But tech stocks have outperformed significantly since then, and today an investment in the Nasdaq would outperform the same investment in the S&P 500 by more than 200 percent.

Gino believes the current sector rotation could continue, but he said, “I actually think this selloff is a pretty good opportunity for long-term investors.”