cnythzl/iStock via Getty Images

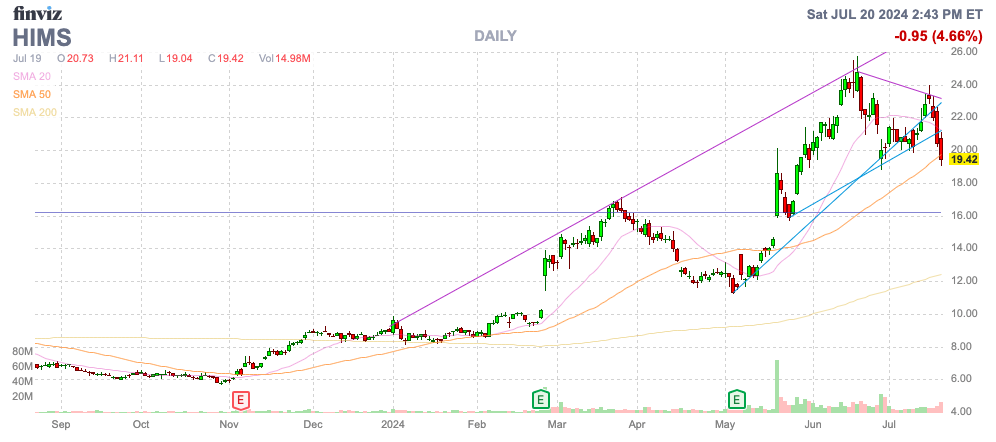

His and her health (NYSE:HIMS) has fallen below $20 as initial excitement over access to a GLP-1 drug solution fades. The online health and wellness company has been hit by shorts again. The report went viral, but the stock price largely ignored the issues raised in the attack. Investment Thesis We remain bullish on the stock in the long term, and the current price makes it a good entry point as we expect the GLP-1 combination drug to boost sales.

Source: Finviz

Dramatic Quarter

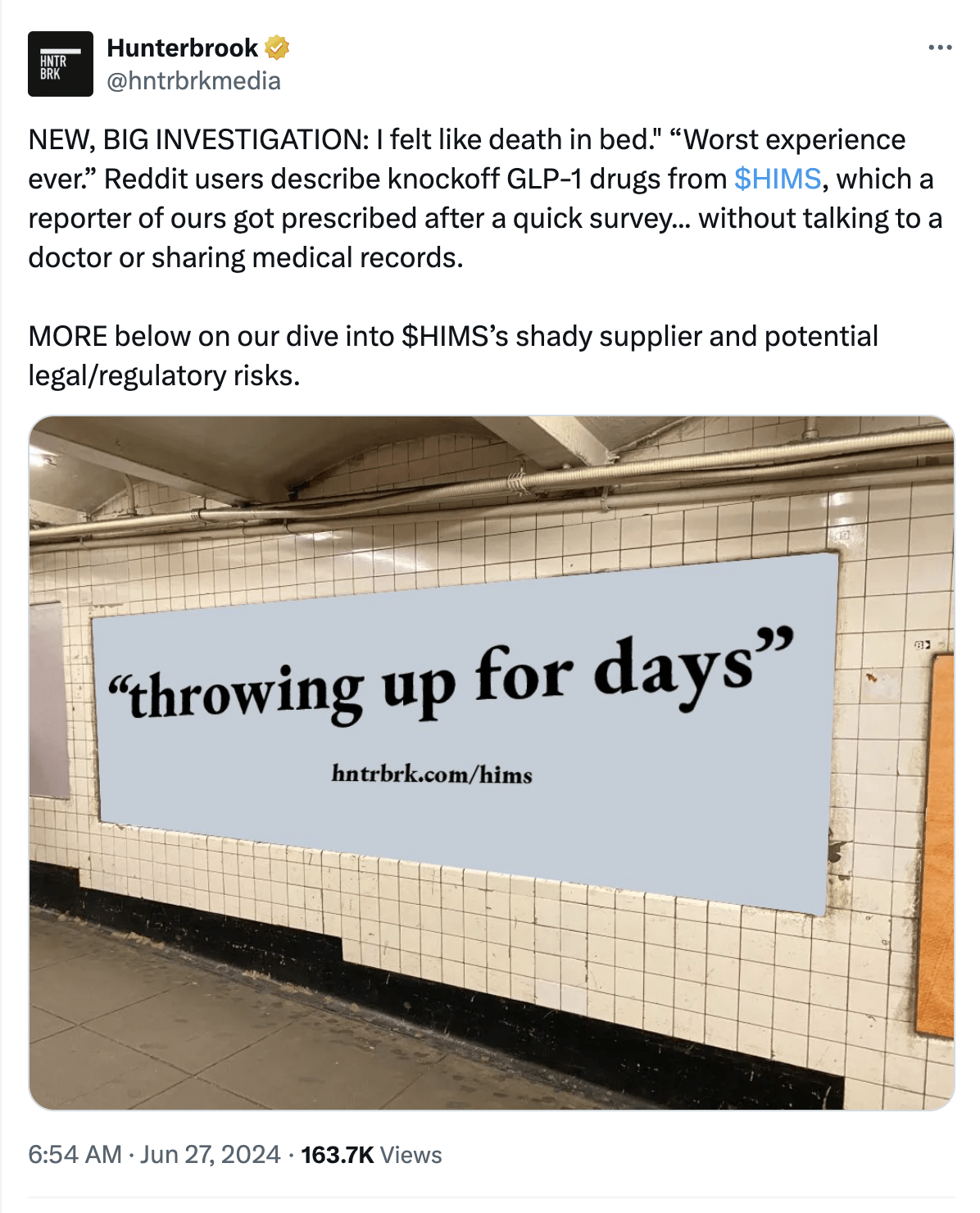

Hims has seen some dramatic news since reporting its first-quarter 2024 financial results in early May. The online medical provider Novo Nordisk (NVO) weight loss pills, a short report from Hunterbrook Media has raised questions about the company’s business practices.

Source: Twitter/X

Hims is Combination semaglutide available now $79/month The oral version costs $199 per pill, and the injectable version costs $199. Because Wegovy does not have enough supply to meet demand, the company is able to offer compounded versions, but compounded versions are not approved or supported by the FDA.

The company already sells weight loss drugs and aims to hit $100 million in sales by 2025, though that estimate didn’t take GLP-1 drugs into account. Not to mention, the short report points out that compounded drugs will not be available for sale until 60 days after the FDA-approved drug shortage is resolved.

In addition to the rising stock price and the unknown outcome of sales of GLP-1 drugs, Himes was hit with a short report from Hunter Brook Media. Like other short attacks, the report focuses on headline-grabbing points but is short on substance.

Although the GLP-1 combination drug is the main focus of this short report, the drug is also not a basis for holding HIMS. All investors should be aware that the drug is an untested knockoff that is not FDA approved.

HIMS can only sell compounded drugs, and its branded GLP-1 drugs Ozempic and Wegovy are in short supply. After existing subscriptions expire in 60 days, HIMS hopes to convert subscribers to users of the branded drugs.

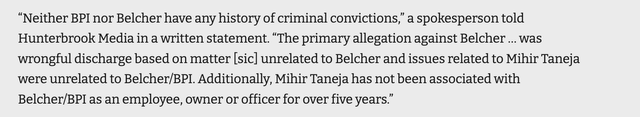

Another big headline from the report was the allegation that the supplier had ties to fraud and a shady history. In fact, Belcher Pharma had executives who were convicted in a fraud scheme in 2020 that were unrelated to Belcher. The two set up fake pharmacies and sold fraudulent drugs.

The following excerpt from the short report shows that the allegations of fraud are unfounded and calls into question the rest of the report.

Source: Hunter Brook Media Reports

Just a year ago, Himes was hit by another short-seller attack, with Spruce Point Research predicting the stock would fall 25% to 40% to $5.20 to $6.50 per share. The report alleged a variety of issues with the health and wellness platform, including its use of shady pharmacy relationships to fill prescriptions.

The stock eventually crept down through the target price range, but Himes made a big splash and the stock quadrupled within a year to a high of over $25. The initial short report did not have a meaningful impact on the stock price, and none of the issues highlighted in the Spruce Point report actually materialized as business problems.

Prime Thesis

The investment case is certainly not based on GLP-1 combination drugs. Hims may benefit from these sales, but such sales are not permanent and will likely only negatively impact future peer reports, not benefit long-term financials. The only real benefit would be for Hims to gain access to actual approved GLP-1 drugs in the future and convert existing customers to its online platform.

The main reason for owning Hims is its focus on personalized health solutions that other industry players don’t offer: the company uses AI and databases to help develop and sell personalized medicines to its subscribers, and it excels at that.

Hims will report its second-quarter 2024 earnings on August 5, with the following expected results:

- Consensus EPS is $0.05

- Consensus revenue was $302 million, up 45% year over year

Along with its Q1 earnings report, Hims forecasted Q2 2024 revenues of $292 million to $297 million, suggesting analysts may be factoring in very limited revenues from GLP-1 drugs. Hims beat consensus estimates for Q1 by more than $9 million and placed Q2 2024 consensus estimates within the normal range.

At $199 per month, the injectable would achieve $1 million in sales at 5,000 prescriptions. Q2 sales are limited due to a late May launch. The bigger positive is the Q3 numbers, which will bring in $3 million in quarterly sales at 5,000 prescriptions per month.

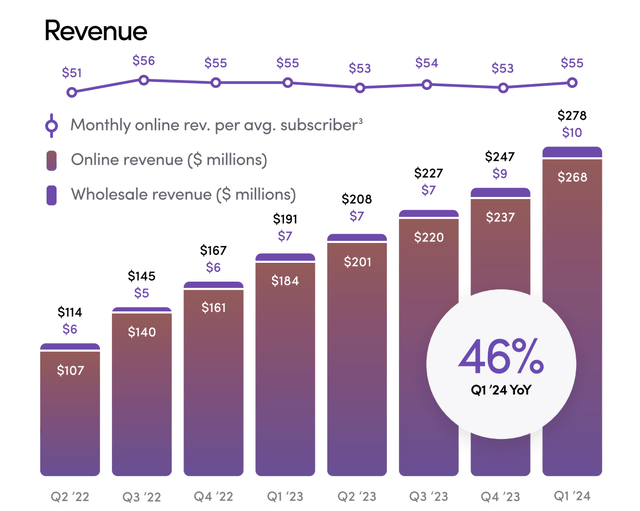

Hims’ average monthly online revenue per subscriber is just $55. The price of any GLP-1 drug compound is significantly higher than the revenue the company generates per subscriber per month.

Source: Hims & Hers Health Q1 2024 presentation

If the stock falls back below $20, its market cap would be $4.2 billion. Hims is no longer trading at a steep discount compared to when it was trading at $6, closer to revenue expectations.

The company’s shares are trading at about 3.5 times its revenue target of $1.6 billion for 2025. Hims shares are still trading at the lowest level for an online health and wealth platform with growth rates of more than 20%.

remove

The key takeaway for investors is that Hims had a strong second quarter, and its actual sales numbers and outlook for the third quarter of 2024 could be shaky. The stock price is oddly down even though the online health and wellness platform is likely to post strong numbers, and Hims is still cheap.

Investors should take advantage of the weakness in the stock price and buy more shares.