Vermont Business Magazine

by Doug Hoffer, Vermont Auditor

The 2024 legislative session began and ended the same way—with widespread concern that a major school tax increase was imminent. Initial estimates indicated that average property tax bills could increase by 18.5 percent in the coming year. Ultimately, thanks to one-time bridge financing that defers the financial calculation to future years, the actual increase was reduced to a still-significant 13.8 percent.

One of the biggest drivers of rising education costs (and the taxes that fund them)? Teacher health care costs. This year alone, they are estimated to increase by 16%. This doesn’t have to happen.

In 2021, My office recommended to the governor and the legislature a strategy used by other states, reference-based pricing., This would reduce these costs and could apply to both teachers’ health care and state employee health care.

Unfortunately, until this year, efforts to study this approach have been unsuccessful. Three years later, the savings potential is even greater, and the cost to Vermont taxpayers of policymakers’ inaction is in the tens of millions of dollars.

You may be wondering how much teachers’ health care costs to begin with.

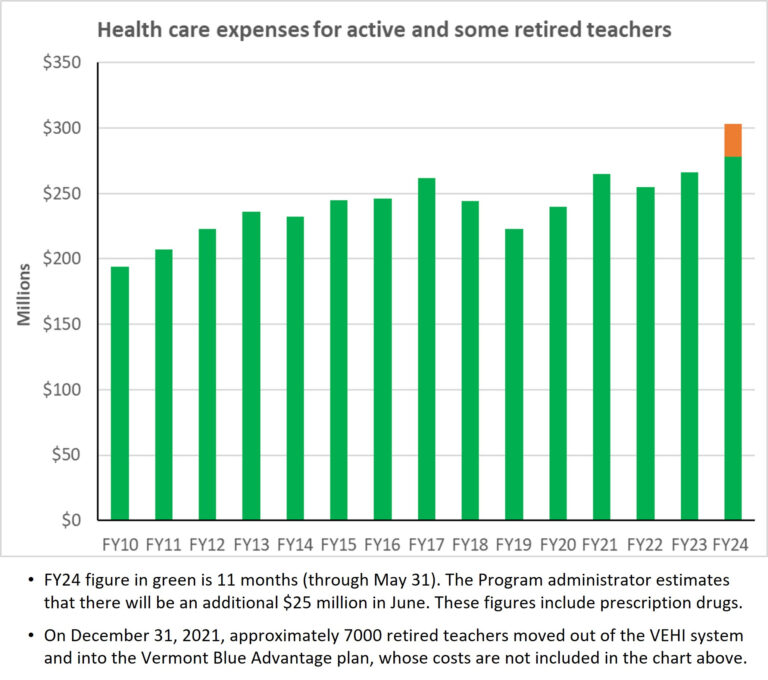

According to the Vermont Education Health Initiative, through which most teachers receive their health benefits, the plan’s costs have increased from $194 million in fiscal 2010 to about $266 million in fiscal 2023. FY 2024 costs are expected to exceed $300 million, and that doesn’t include the state’s share of health benefits for most retired teachers.

State employee health care faces similar pressures. Total spending for Vermont’s state employee health insurance plan has, with the exception of a COVID-related decline in 2020, increased steadily and dramatically since 2010.

In 2023, this amount increased to a record $196.6 million. The cost of the state employee insurance plan has increased by 109% since 2010, while the number of people covered has increased by only 19% during the same period.These figures do not include prescription drug costs, which rose from $22.9 million in 2010 to $59.2 million in 2023.

Should these price increases affect education and public services or lead to big tax increases? The answer is no.

Should these price increases affect education and public services or lead to big tax increases? The answer is no.

Our 2021 edition report It is estimated that reference pricing could save up to $16.3 million per year for the state employee health insurance plan alone. Given its size and greater costs, even greater annual savings would be possible in the area of teacher health care..

How does “reference pricing” work? Simply put, reference pricing sets a fair price for a particular medical service and then pays only that amount (or a fixed percentage of it) to any provider who provides the services to people covered by the health insurance plan. In other words, it sets a maximum price at which the plan will pay for a service rather than just paying the byzantine prices negotiated by insurance companies and hospitals, even if they are excessive.

What problem does reference-based pricing solve? State employee and teacher health insurance plans pay state hospitals a wide range of prices for exactly the same procedures. For example, we found that the difference between the most expensive supplier for a received scanner is 5.8 times greater than that of the cheapest supplier!

The state is self-insured, meaning it pays for every medical service a state employee uses on a pay-as-you-go basis. When a state employee unknowingly chooses a relatively expensive provider, the taxpayer-funded plan pays the premium; when the same employee chooses a less expensive provider, the plan saves money.

Have other states adopted reference pricing, and if so, has it worked? Yes, and a resounding yes.

- THE State of Montana has used reference-based pricing for inpatient and outpatient services in acute care hospitals for its state employees since 2017. Independent researchers Montana Determined saved $47.8 million during state fiscal years 2017 through 2019 (an average of $15.9 million per year).

- THE State of Oregon shared his experience with reference pricing for government employees and teachers. Audit They were conducted on the basis of claims estimated for 2021 $112.7 million in savings for their plan because of the reference-based pricing.

- In both states, no reduction in health care choice was observed for state employees or teachers, and no impact was observed on hospital operations.

A study on reference-based pricing in Vermont has finally been approved and will be released by December. If Montana and Oregon are any examples, interest groups can be expected to oppose this major cost-cutting reform. But if Vermont chooses to pursue this strategy and the Scott administration, the legislature, school administrators, and unions representing state employees and teachers stand up to the guardians of the status quo, the taxpayers they serve will reap significant financial benefits.

In short, we must not stand by and let rising health care costs lead to higher taxes and strain public education and state budgets.

Respectfully,

Vermont State Auditor

132 State Street

Montpelier, Vermont 05633-5802

www.auditor.vermont.gov