lkunl/iStock via Getty Images

Overview of opportunities

Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk (New York Stock Exchange: TLK) is a leading telecommunications company in Indonesia with global operations. It has a market share of over 60% in one of the most populous countries in the world and has an extensive distribution network. The group has significant growth potential this decade if it can gain market share and raise prices. It also operates about 38,000 towers, making it the largest tower supplier in Southeast Asia.

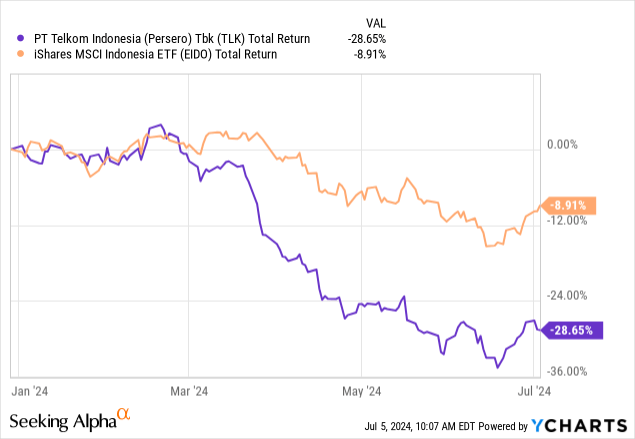

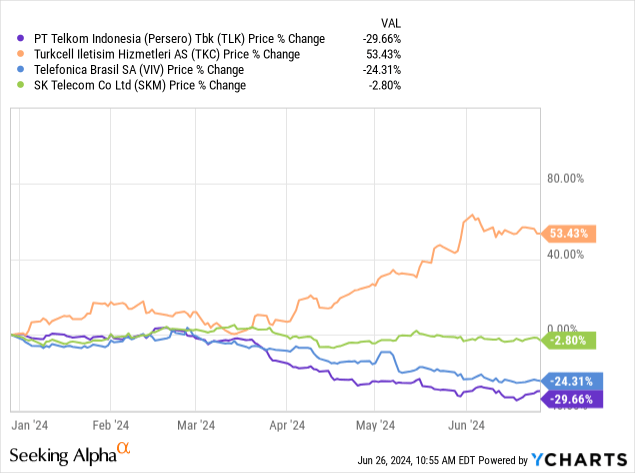

The stock has fallen sharply this year, largely due to pricing concerns, but the company’s financial performance has remained acceptable. The company is still positioned to see moderate revenue growth this year due to new customer acquisitions. Additionally, pricing concerns only affect a smaller segment and did not have a significant impact on the company’s financial performance this quarter, as its ARPU did not decline. The stock appears to be very oversold, as evidenced by its recent sharp rise underperformance despite decent quarterly results in Q1 2024.

The stock underperformed the iShares MSCI Indonesia ETF by about 20 percentage points. There are also plenty of macroeconomic catalysts that could support the Indonesian stock market, with the World Bank recently upgrading its growth forecast for Indonesia to 5.1% this year. Inflation has also recently fallen below 3%, which should help support consumer sentiment. Telkom Indonesia is well-positioned to benefit from these new macroeconomic trends, as a major telecommunications player with a strong market share in the Indonesian market.

I think this month is a great time to start a larger position, especially since its latest quarterly results were favorable and its outlook for 2024 is also good. This may be a good time to accumulate ahead of its next quarterly earnings call, when it could announce more positive results.

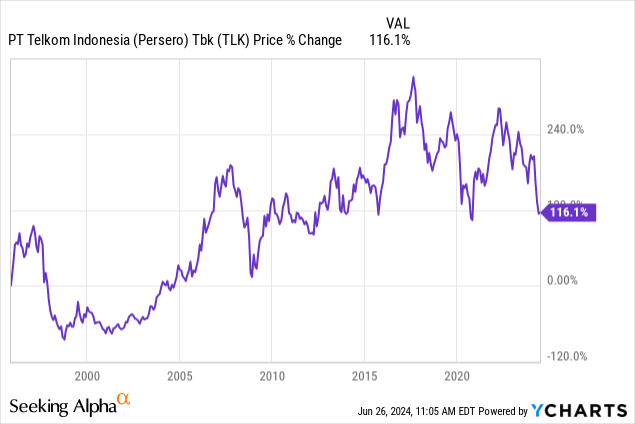

Shares have pulled back significantly since I last covered this company in 2022, and I think the company looks like a much stronger buy given its renewed growth prospects in 2024 and its lower valuation.

The appeal of the Indonesian market

The Indonesian telecommunications market could become one of the largest markets in the world in the future. Indonesia is currently the fourth most populous country in the world and its GDP per capita is only $4,000. Although the overall market is only growing moderately, companies like Telkom Indonesia have managed to outperform thanks to their existing customer base and new offerings. Telkom Indonesia also has the potential to tap into growth opportunities in other countries, as it recently did in Singapore with its data center business segment.

Indonesia is a very attractive market due to its population and the potential for wage growth in the coming years. Indonesia has also recently regained its upper-middle-income status with the World Bank in 2023. The country’s minimum wage has increased significantly and was recently increased by 10% in 2023. In the long term, Indonesian telecom stocks should benefit significantly if incomes continue to rise over the next decade.

Company Outlook

The company’s growth targets include capturing additional market share in the Indonesian market and expanding into other countries such as Singapore. The company recently established InfraCo and TDE in Singapore and may also sell one of its data centers in Singapore this year. Telkom Indonesia has been expanding globally by introducing new data centers to meet some of the increased demand generated by AI. This is a new catalyst that the company announced this year, which could help support the company’s share price performance this year.

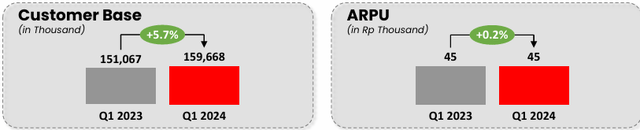

While there are concerns about the lower prices of its new segments, they only cater to a smaller portion of the population. Moreover, this strategy has also helped the company gain market share. Its new Indihome offering has helped the company gain new customers and could be a relevant long-term growth driver for the company, something that has not been apparent in recent quarterly earnings reports. Telkom Indonesia was able to increase its customer base by more than 8 million in 2023 to reach 159.3 million.

This is a positive development for the company in the long term, as its new offerings have helped it win new customers. Moreover, this transition has not had a significant impact on the company’s ARPU.

Telkom Indonesia

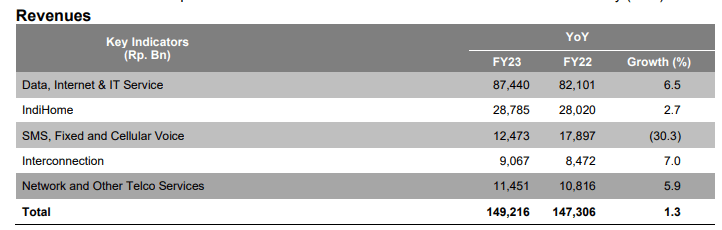

Overall, its revenue grew by 1.6% in 2023, while it saw stronger growth in other areas such as its Indihome and mobile data user segments. Notably, its SMS, fixed and cellular revenues fell by 30%, which is worrying as this segment previously accounted for more than 10% of its total revenue.

Talk

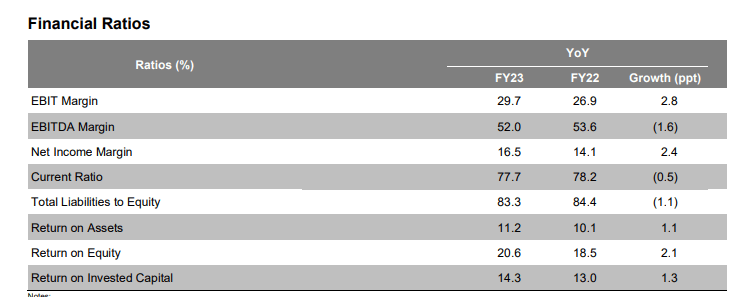

Telkom Indonesia has also continued to be highly profitable in recent years, with many metrics at or above levels seen in other regional telecom competitors. It improved its net profit margin and EBIT margin by more than 200bps in 2023.

Talk

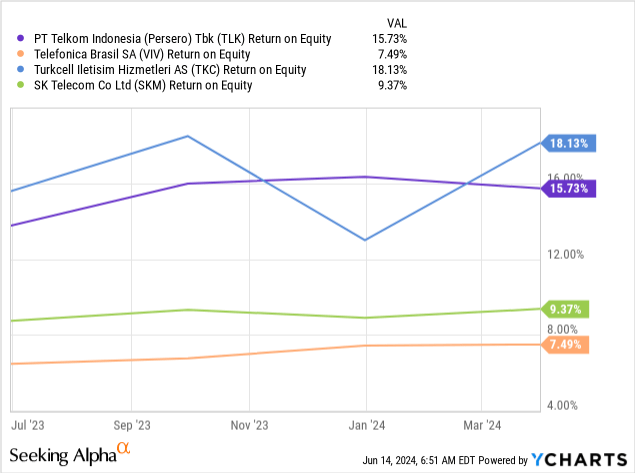

Its ROE and ROE are still well above many regional emerging market peers, with the exception of Turkey-based Turkcell Iletisim Hizmetleri AS (TKC).

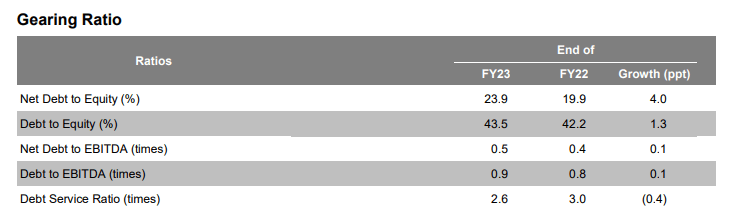

Telkom Indonesia posted healthy free cash flow, despite having to invest about 22% of its revenue in capital expenditures and despite its operating cash flow declining last year. It also posted a relatively healthy balance sheet, with low foreign currency-denominated debt and reasonable gearing ratios.

Talk

First quarter performance remains favourable

Telkom Indonesia, however, posted relatively favorable performance in the first quarter of this year, so the year-to-date decline in business may be overstated. The company’s revenue grew more than 3% in the latest quarter, driven by 8.6% growth in its digital business segment.

One important trend to note is that the drop in its stock price was driven by concerns about its pricing. However, the company recently noted that its ARPU has remained stable and it has been able to win over new customers with its new offerings. In the long run, this pricing model could give the company more room to gain market share and eventually start selling to some of these customers.

The company’s international operations were also a key driver of growth this quarter. Its international voice wholesale business grew more than 17%, well above its average revenue growth rate. Its data center and cloud revenue also grew 6%, largely driven by its data centers in Singapore.

Telkom Indonesia has strong growth potential and has continued to invest heavily for its future growth. Capital expenditures during the first quarter of 2024 accounted for approximately 13% of its revenue and were mainly focused on expanding its network infrastructure and improving its user experience.

While Telkom’s share price has been falling and moving sideways as if it were a value trap, there actually appear to be several avenues for growth to be driven in the coming quarters. All other segments of its business remain healthy, and the company also has attractive data centre offerings. Moreover, some of the concerns about declining revenue per user appear overblown, given this past quarter’s data.

Take away

Telkom Indonesia looks like a great buy after its sharp decline this year.

This year, Telkom Indonesia has lagged most of its peers, despite its positive financial results and growth outlook. Telkom Indonesia appears to be a better choice than other Indonesian ETFs, which are heavily invested in financial stocks and have less exposure to consumer themes.

Telkom Indonesia has many attractive growth prospects, which could materialize in the coming quarters. In addition, many concerns regarding its pricing model could be resolved in the coming quarters.

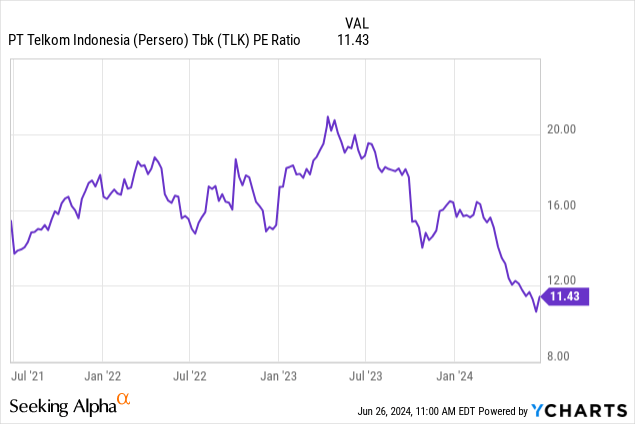

One of the main risks of this company is that its revenue growth rate has not been very high, although some segments have started to shine in recent months. As a result, the market has started to value this company as a value trap, as evidenced by the rapid decline in its price-to-earnings ratio.

It is also essential to consider economic risks in Indonesia, as the currency begins to depreciate slightly after its strong performance in 2023. However, the country’s central bank has contained inflation at around 3% and may be able to cut rates to boost growth. The World Bank’s latest projections call for growth of over 5% in Indonesia, which would be well above the emerging market average.

The biggest risk is probably that this is a waiting period, as the stock price could move sideways or even fall if there is bad news. However, this seems like a really solid entry point when you consider the long-term historical performance and the current dividend yield.

Stocks have generated respectable returns over the long term and are currently well below the highs of the last decade.