(Bloomberg) — European stocks rose as key elections held center stage and as traders assessed the case for Federal Reserve interest-rate cuts following US economic data that supported the case for easing.

Most Read from Bloomberg

France’s CAC40 benchmark index advanced for a second day in the buildup to this weekend’s final round of voting in snap parliamentary elections. Voting is underway in the UK’s general election, where investors will need to wait until 10 p.m. local time for the first official exit polls.

Europe’s regional Stoxx 600 index climbed 0.5%, with autos and banking stocks the leading gainers. US equity futures contracts were little changed with cash markets shut for Independence Day. The S&P 500 and the Nasdaq 100 index set fresh record highs in Wednesday’s holiday-shortened session.

In individual stock moves, Continental AG rallied as much as 12% after the tiremaker flagged strong growth in China. Roche Holding AG dropped after a lung-cancer drug failed to meet the main goal in a clinical trial.

Morgan Stanley strategists said investors should buy French stocks before Sunday’s vote, because the market is likely to rebound in either of the two most probable outcomes.

French bonds already have been lifted by the political maneuvering that seeks to block Marine Le Pen’s National Rally from winning an absolute majority in the National Assembly, Morgan Stanley’s Marina Zavolock and Regiane Yamanari wrote in a report. Stock investors should follow their lead and add exposure to the country, they said.

Thursday’s gains for stocks were stronger in Asia, where an MSCI gauge of the region’s stocks hit its highest point in over two years, with technology shares contributing the most to the rally. Japan’s Topix climbed to a record high.

The yen strengthened after once again touching its lowest level since 1986 against the greenback in the previous session. Speculation persists that the Bank of Japan will tighten policy only gradually. A gauge of dollar weakened for a third day.

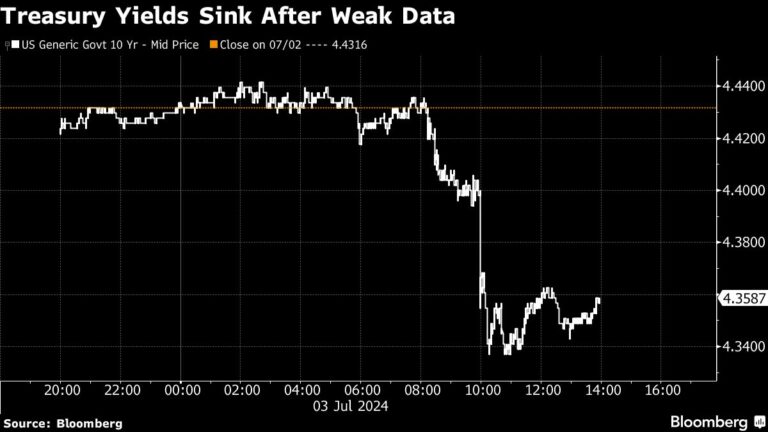

“Weaker Treasury yields and a dip in the US dollar on dovish rate bets may be supportive of risk sentiments across the region,” said Jun Rong Yeap, market strategist at IG Asia Pte. The “slowing US growth prospects” are making a September rate cut “more likely than not,” he said.

Global stocks are on track for their longest stretch of weekly gains since March, driven by a series of soft economic data in the US, which has revived the possibility of rate cuts in September. On Wednesday, reports showed the American services sector contracted at the fastest pace in four years, and the labor market saw further signs of softening.

Minutes from the Fed’s June policy meeting showed officials were awaiting evidence that inflation is cooling and were divided on how long to keep rates elevated. Swap traders projected almost two rate cuts in 2024, with the first in November — though bets on a September reduction increased.

Traders are tracking speculation that President Joe Biden could scrap his run for re-election. Wall Street has started shifting money to and from the dollar, Treasuries and other assets that would be affected by a victory for Donald Trump in November.

“The UK and French elections will be more of a temporary concern for the markets,” Adrian Zuercher, chief investment officer at UBS AG Private Banking told Bloomberg Radio. “Trump is a different story, particularly, the trade war situation. We will have to see how aggressive he will be on tariffs and that might resonate a little bit longer” with markets, he said.

Friday’s US jobs report provides the next piece of data as investors assess the path for interest rates. Economists anticipate a 190,000 gain in June non-farm payrolls — less than the previous month — with the unemployment rate holding at 4%.

“Given other evidence of a cooling economic backdrop, the payroll report could be increasingly decisive for the Fed as it seeks a rationale to signal an easing of rates,” said Quincy Krosby at LPL Financial.

Chicago Fed President Austan Goolsbee said there’s still a lot of data the US central bank needs to see before gaining the confidence to cut interest rates.

In commodities, iron ore futures climbed to the highest level in nearly a month on optimism for improvement in demand from China.

Key events this week:

-

UK general election, Thursday

-

US Independence Day holiday, Thursday

-

Eurozone retail sales, Friday

-

US jobs report, Friday

-

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 rose 0.3% as of 8:33 a.m. London time

-

S&P 500 futures were little changed

-

Nasdaq 100 futures were little changed

-

Futures on the Dow Jones Industrial Average were little changed

-

The MSCI Asia Pacific Index rose 1%

-

The MSCI Emerging Markets Index rose 0.9%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.1%

-

The euro was little changed at $1.0792

-

The Japanese yen rose 0.2% to 161.43 per dollar

-

The offshore yuan was little changed at 7.2990 per dollar

-

The British pound was little changed at $1.2745

Cryptocurrencies

-

Bitcoin fell 1.8% to $58,442.06

-

Ether fell 2.1% to $3,188.51

Bonds

-

The yield on 10-year Treasuries was little changed at 4.36%

-

Germany’s 10-year yield advanced two basis points to 2.60%

-

Britain’s 10-year yield advanced two basis points to 4.19%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Richard Henderson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.