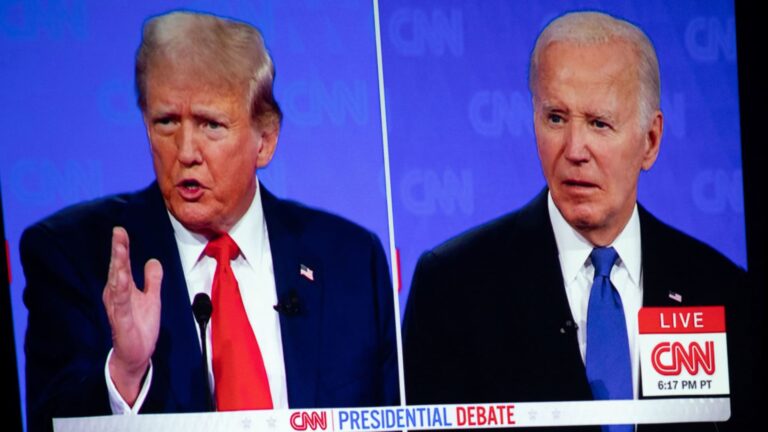

Since U.S. presidential elections occur every four years, there isn’t much data to analyze. We are currently in an election year, exactly halfway through it as of today, July 1, 2024. The S & P 500 has yielded an average return of 7.9% since 1928, the year Herbert Hoover was elected. However, focusing only on presidential election years, the average return slightly drops to 7.5%. Interestingly, if a sitting president is running for reelection, the average return increases to 9.3%; it further improves to 9.9% if the incumbent wins and stands at 7.9% when the incumbent loses, as seen with Hoover, Carter, George H.W. Bush, and Trump. LBJ’s election in 1964, a year when the S & P returned 13%, might suggest that JFK could have been reelected. LBJ’s presidency was also notable because he chose not to seek reelection in 1968, a year with a modest S & P return of 7.7%. Why does the market tend to outperform when incumbents are reelected? It could be due to the electorate’s confidence in the economy or their belief in the incumbent’s capability to handle the nation’s challenges, as was likely the case with FDR. .SPX YTD mountain S & P 500, year-to-date As of Friday’s close, the S & P 500’s total return for this year stands at approximately 15.3%, which is better than average and surpasses the returns typically seen when an incumbent wins or loses. The economy appears stable, with low unemployment, modest growth, and a 6.4% increase in S & P earnings for June compared to the previous year. Atypical election year Will this strong performance continue through the end of the year? Regardless of political preferences, this presidential election is atypical. Biden’s fitness for office is being questioned even by some staunch supporters, raising the possibility of his withdrawal. Meanwhile, Trump faces ongoing legal issues. We may be in precarious territory when combining election uncertainty with current market valuations. The S & P 500 is just off its mid-June all-time highs, with price-to-sales ratios at 3 times and price-to-forward earnings around 23 times —above average. A market correction could be more likely now than it seemed two weeks ago, as suggested by the current pricing of S & P options. On December 31, 2024, 5350 puts showed higher implied volatility than previously, and 5550 calls were priced lower. What should investors do? Betting against high-performing companies like Nvidia, which are experiencing unique growth and are less influenced by political issues, may not be wise. Instead, hedging the S & P itself could be a prudent strategy. Options such as SPDR S & P 500 ETF Trust (SPY) August $535 puts are currently priced around $5.50, about 1% of SPY’s price, while S & P 500 5350 puts are around $50. These options could protect one’s portfolio through the Democratic National Convention in the second half of August. SPY YTD mountain SPDR S & P 500 ETF Trust If a correction does occur, investors could monetize, roll, or spread the hedge. If election fears are unfounded, the cost of this protection will be about 1%. DISCLOSURES: (None) All opinions expressed by the CNBC Pro contributors are solely their opinions and do not reflect the opinions of CNBC, NBC UNIVERSAL, their parent company or affiliates, and may have been previously disseminated by them on television, radio, internet or another medium. THE ABOVE CONTENT IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY . THIS CONTENT IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSITUTE FINANCIAL, INVESTMENT, TAX OR LEGAL ADVICE OR A RECOMMENDATION TO BUY ANY SECURITY OR OTHER FINANCIAL ASSET. THE CONTENT IS GENERAL IN NATURE AND DOES NOT REFLECT ANY INDIVIDUAL’S UNIQUE PERSONAL CIRCUMSTANCES. THE ABOVE CONTENT MIGHT NOT BE SUITABLE FOR YOUR PARTICULAR CIRCUMSTANCES. BEFORE MAKING ANY FINANCIAL DECISIONS, YOU SHOULD STRONGLY CONSIDER SEEKING ADVICE FROM YOUR OWN FINANCIAL OR INVESTMENT ADVISOR. Click here for the full disclaimer.